Fulcrum Perspectives

An interactive blog sharing the Fulcrum team's policy updates and analysis.

Recommended Weekend Reads

The Future of NATO and the Transatlantic Relationship, Are Trump’s Tariffs Working? And The Persistent Global Fertility Decline

February 13 - 15, 2026

Below are several reports and articles we read this past week that we found particularly interesting. I hope you find them both interesting and useful. Have a great weekend.

The Future of NATO and the Munich Security Conference

NOTE: With the Munich Security Conference taking place this weekend, we wanted to bring focus to several of the key issues being discussed and debated.

Trump’s NATO Dilemma – America Can’t Disengage from the Alliance and Also Lead It Sara Bjerg Moller/Foreign Affairs

Amid a sea of disruptions—territorial threats against Denmark, missed alliance meetings by senior U.S. diplomats, and planned personnel reductions at NATO installations—the Trump administration’s second-term approach to NATO is now coming into focus. Rather than openly abandoning the alliance, as some analysts feared, the United States appears to be “quiet quitting”: incrementally stepping away from the alliance it has led for close to eight decades. The White House seems to believe that only if the United States steps back will Europe finally be forced to step up. But it will find that walking away from overseeing NATO’s military machinery is far harder than anticipated. NATO’s command structure was built around U.S. infrastructure and personnel, and no other member of the alliance is currently equipped to replace Washington. If Trump does choose to push ahead with his planned disengagement, the logistics of succession would be the least of the United States’ concerns. No major power has ever voluntarily surrendered control, much less command, of an alliance it built and led. Doing so at a moment of profound geopolitical upheaval would weaken the transatlantic partnership—and leave the United States less secure.

Poll: Top NATO allies don’t think the US helps deter enemies anymore Politico EU

As global leaders convene in Germany for the Munich Security Conference, new results from The POLITICO Poll show President Donald Trump’s efforts to rewrite longstanding international relationships — particularly in Europe — are repelling longtime, traditionally loyal partners. The United States’ eroding reputation is raising fresh questions about the stability of the global order that has held for decades, and of the country’s strength on the world stage. Across all countries polled, far more people described the U.S. as an unreliable ally than a reliable one, including half the adults polled in Germany and 57 percent in Canada. In France, too, the share of people who called the U.S. unreliable was more than double the share who said it was reliable.

Can Germany's Merz be the savior of Europe? Reuters Commentary

European Union leaders are meeting this week to discuss how to boost the bloc's competitiveness. While President Donald Trump’s withering description of Europe last month as a "decaying" region was unwelcome, it may be what finally prompts them to take much-needed action. Germany has historically been a brake on EU reform, but Berlin now appears to be on board. Chancellor Friedrich Merz told the World Economic Forum in Davos last month that the EU now had no choice but to urgently pursue former European Central Bank president Mario Draghi’s blueprint for a competitive Europe.

Europe’s Next Hegemon: The Perils of German Power Liana Fix/Foreign Affairs

After many delays, Germany’s Zeitenwende—its 2022 promise to become one of Europe’s defense leaders—is finally becoming a reality. In 2025, Germany spent more on defense than any other European country in absolute terms. Its military budget today ranks fourth in the world, just after Russia’s. Annual military spending is expected to reach $189 billion in 2029, more than triple what it was in 2022. Germany is even considering a return to mandatory conscription if its military, the Bundeswehr, cannot attract enough voluntary recruits. Should the country stay the course, it will again be a great military power before 2030.

Vladimir Putin is trapped in a war he cannot win but dare not end Peter Dickerson/The Atlantic Council

Putin’s reluctance to accept Trump’s offer makes perfect sense when viewed from the perspective of the Russian ruler’s revisionist worldview and imperial ambitions. Crucially, Putin is well aware that any peace deal based on the current front lines of the war would leave 80 percent of Ukraine beyond Kremlin control and free to integrate into the democratic world. That is exactly what he is fighting to prevent. As the war enters a fifth year, Putin finds himself in an unenviable predicament. He has no obvious pathway to victory, but cannot agree to a compromise peace without acknowledging what would amount to a historic defeat and placing his own political survival in question.

Tariffs, Trade, and Geoeconomics

Who Is Paying for the 2025 U.S. Tariffs? Federal Reserve Bank of New York

The Federal Reserve Bank of New York is out with a new analysis that finds ~90% of tariffs’ economic burden was borne by American firms and consumers in the first 8 months of 2025. Between January and November, however, that incidence declined 88 percent as firms reorganized supply chains.

Americans Largely Disapprove of Trump’s Tariff Increases Pew Research Center

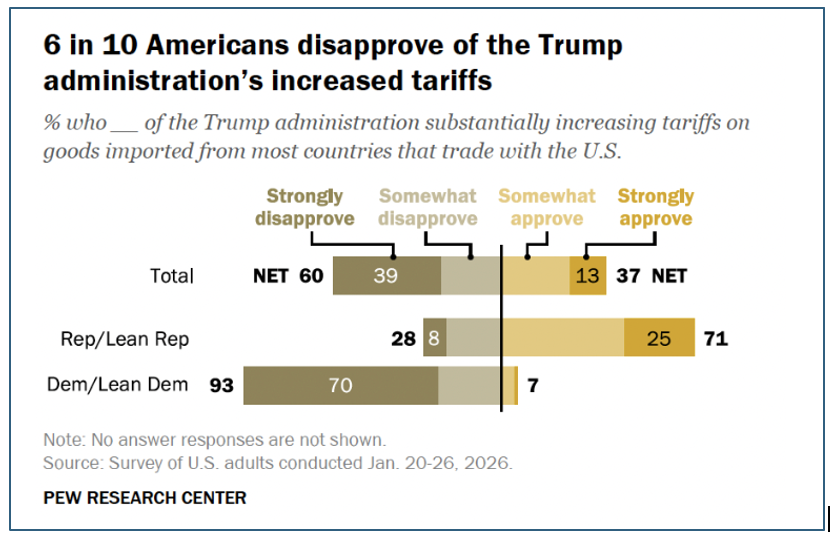

By a wide margin, Americans continue to say they disapprove of the Trump Administration substantially increasing tariffs: 60% say, including 39% who say they strongly disapprove. By contrast, 37% say they approve of the increased tariffs, and just 13% strongly approve. Views of the Administration’s tariff increase have been relatively stable since last April, when President Donald Trump unveiled his far-reaching tariff policy.

Trump Tariffs: Tracking the Economic Impact of the Trump Trade War The Tax Foundation

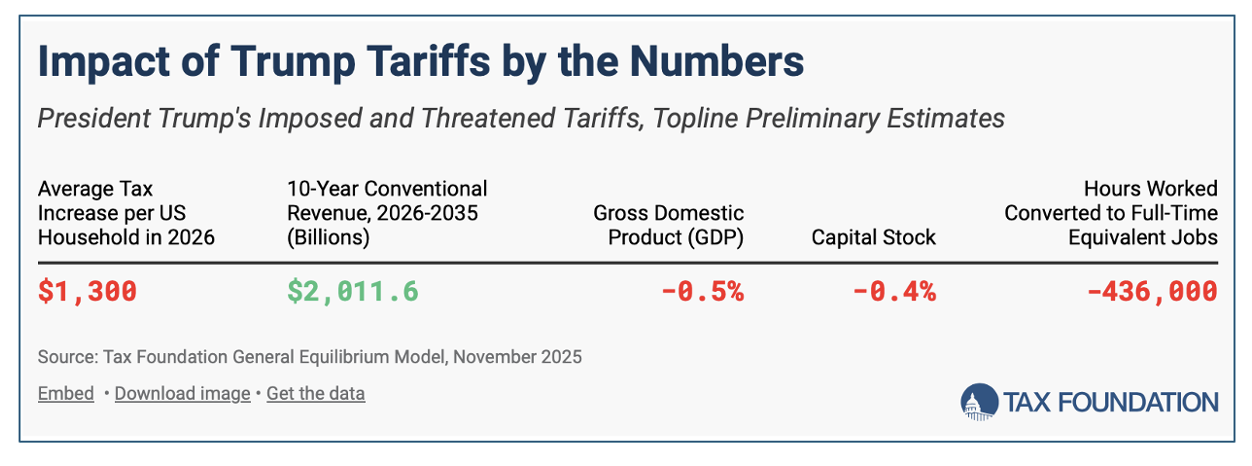

President Trump has imposed International Emergency Economic Powers Act (IEEPA) tariffs on US trading partners, including China, Canada, Mexico, and the EU. In addition, he has threatened and imposed Section 232 tariffs on autos, heavy trucks, steel, aluminum, lumber, furniture, semiconductors, pharmaceuticals, and copper, among others. The Trump tariffs amount to an average tax increase per US household of $1,000 in 2025 and $1,300 in 2026. Under the tariffs imposed and scheduled as of February 6, 2026, the weighted average applied tariff rate on all imports rises to 13.5 percent, and the average effective tariff rate, reflecting behavioral responses, rises to 9.9 percent—the highest average rate since 1946. The Trump tariffs are the largest US tax increase as a percent of GDP (0.54 percent for 2026) since 1993. Trump’s imposed tariffs will raise $2.0 trillion in revenue from 2026-2035 on a conventional basis and reduce US GDP by 0.5 percent, all before foreign retaliation. Accounting for negative economic effects, the revenue raised by the tariffs falls to $1.6 trillion over the next decade. We estimate that the tariffs raised $132 billion in net tax revenue in 2025. The Trump tariffs threaten to offset much of the economic benefits of the new tax cuts, while falling short of paying for them.

Demographic Trends and Employment Gaps

The Likelihood of Persistently Low Global Fertility Journal of Economic Perspectives

Low fertility is likely to persist as a global phenomenon as pro-natal policies have been insufficient to “adequately challenge conventions, challenge social orders, and challenge what gets society’s attention, power, and investment.”

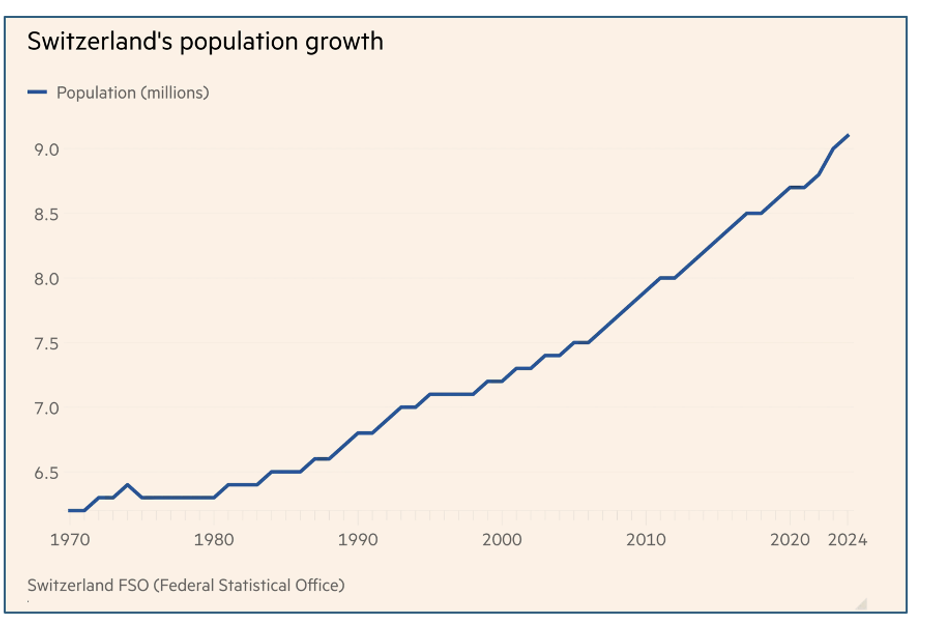

Switzerland To Vote On Plan To Cap Population At 10mn Financial Times

Switzerland will hold a vote on a radical proposal to cap the country’s population at 10mn people, a move that could threaten crucial agreements with the EU and limit companies’ access to skilled foreign workers. The country’s current population is 9.1 million people, and Switzerland has a high level of immigration, as people are drawn by its high wages and quality of life. It has one of the largest proportions of foreign residents in Europe, at 27% according to official figures, and its population has grown by some 25% since 2000, much higher than most neighboring countries.

The H-1B Wage Gap, Visa Fees, and Employer Demand George J. Borjas/National Bureau of Economic ResearchAbstract: The H-1B program lets firms hire high-skill foreign workers for a six-year term. The annual number of visas allocated to for-profit firms is capped at 85,000 and there is excess demand for those visas. The analysis merges administrative data, including the I-129 petitions that report the wage offer made to specific H-1B beneficiaries, with the American Community Surveys. On average, H-1B workers earn 16 percent less than comparable natives, suggesting that firms may be willing to pay a one-time fee to obtain the visa. The data are examined using a labor demand model to simulate how a fee alters the hiring decision. Depending on the level of excess demand, the unobserved productivity gains or costs from an H-1B hire, and the rate of job separations, the revenue-maximizing fee is between $118,000 and $264,000, has little or no impact on the number of H-1Bs hired, and generates between $6.2 and $22.4 billion in revenues. The demand for visas remains strong even if firms offshore some of the jobs currently held by H-1Bs. The fee also changes the skill composition of the H-1B workforce, making it more skilled.

Weekend Reads

Mexico – US Relations Get More Tense, Russia Hitting a Critical Inflection Point Internally, How American First Investment Pledges Are Structured – But Will It Work? , And the Impact of Inflation on Fertility

January 30 - February 1, 2026

Below are several reports and articles we read this past week that we found particularly interesting. Hopefully, you will find them of interest and useful as well. Have a great weekend.

Americas

‘What the hell do we do with this issue’: Mexico confronts Trump’s Cuba pressure Politico

President Donald Trump’s increasingly overt attempts to bring down the Cuban government are forcing Mexican President Claudia Sheinbaum into a delicate diplomatic dance. Mexico is the U.S.’s largest trading partner. It is also the primary supplier of oil to Cuba since the U.S. seized control of Venezuela’s crude. Now, Sheinbaum must manage her relationship with a mercurial Trump, who has at times both praised her leadership and threatened to send the U.S. military into her country to combat drug trafficking — all while appeasing her left-wing party Morena, factions of which have historically aligned themselves with Cuba’s communist regime.

Washington’s Sharpening Stance on Mexico Americas Quarterly

There is a deep shift underway in Washington—one that redefines Mexican organized crime not primarily as a law-enforcement problem or a bilateral cooperation challenge, but as a direct national security threat to the U.S. That redefinition is already reshaping U.S. policy tools, institutions, and expectations vis-à-vis Mexico, with potentially profound consequences for the bilateral relationship.

Can anything halt Latin America’s lurch to the right? Financial Times

“It’s because of the expansion of the major criminal markets in the region,” says Council on Foreign Relations Fellow Will Freeman. “The huge increase in the size of the cocaine trade, the boom in illegal gold mining, for a time, the wave of human smuggling, and the way that has seeded a lot of new gangs and criminal outfits in different parts of the region that didn’t previously have to deal with this.” The dramatic capture of Venezuela’s authoritarian president, Nicolás Maduro, by US commandos in the early hours of January 3 has, if anything, reinforced the swing to the right in most of the region, pollsters say.

Is Russia at a Critical Inflection Point?

Russia’s Grinding War in Ukraine Center for Strategic and International Studies

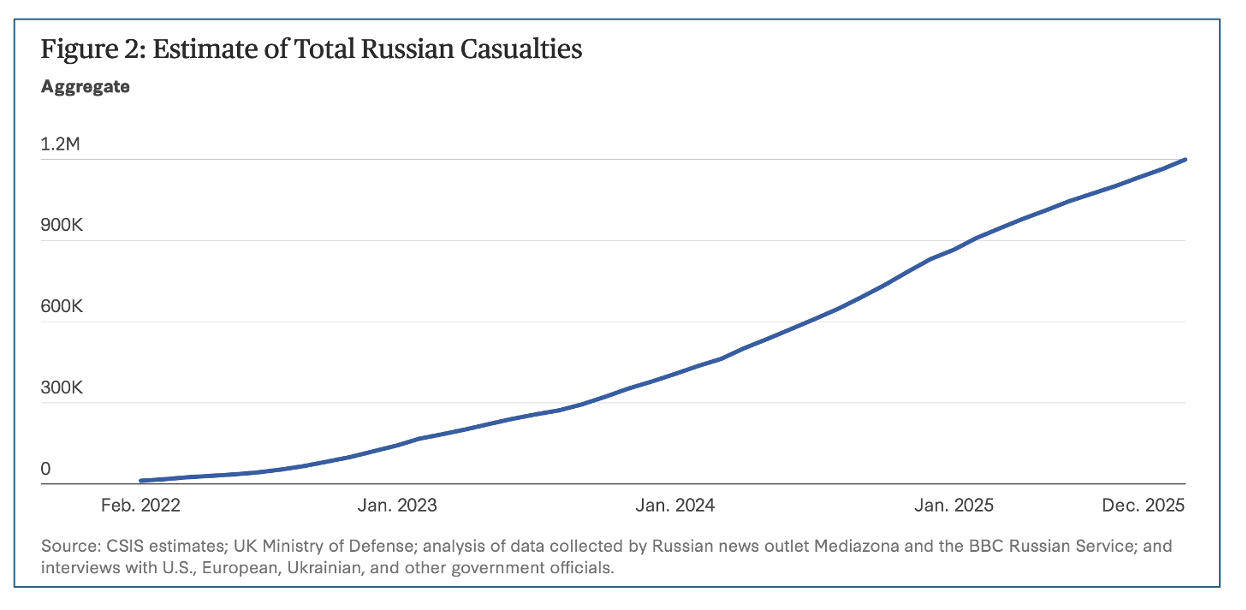

Despite claims of battlefield momentum in Ukraine, the data show that Russia is paying an extraordinary price for minimal gains and is in decline as a major power. Since February 2022, Russian forces have suffered nearly 1.2 million casualties, more losses than any major power in any war since World War II. At current rates, combined Russian and Ukrainian casualties could reach 2 million by the spring of 2026. After seizing the initiative in 2024, Russian forces have advanced at an average rate of 15-70 meters per day in their most prominent offensives, slower than almost any major offensive campaign in the last century. Meanwhile, Russia’s war economy is under mounting strain, with manufacturing declining, growth slowing to 0.6 percent in 2025, and no globally competitive technology firms to drive long-term productivity.

Russian Economy’s “Unholy Trinity”: Recession, Inflation, Budgetary Crisis Free Russia

The Russian economic situation has reached a breaking point in 2026, facing the “unholy trinity” of challenges:

The ongoing budget crisis, which is set to exacerbate in 2026 due to a shortfall of oil and gas export revenues as well as under-collection of domestic taxes due to cooling of the Russian economy;

High inflation, which has not been brought under control - contrary to widespread public misconception, and which still requires maintaining prohibitively high interest rates thus diminishing Russians’ real incomes;

A looming recession, which seems inevitable given the lack of sources of potential major economic revival (no fiscal stimulus, an inability to access international investment and financial markets, expensive credit, shrinking corporate profits, etc.).

Geoeconomics

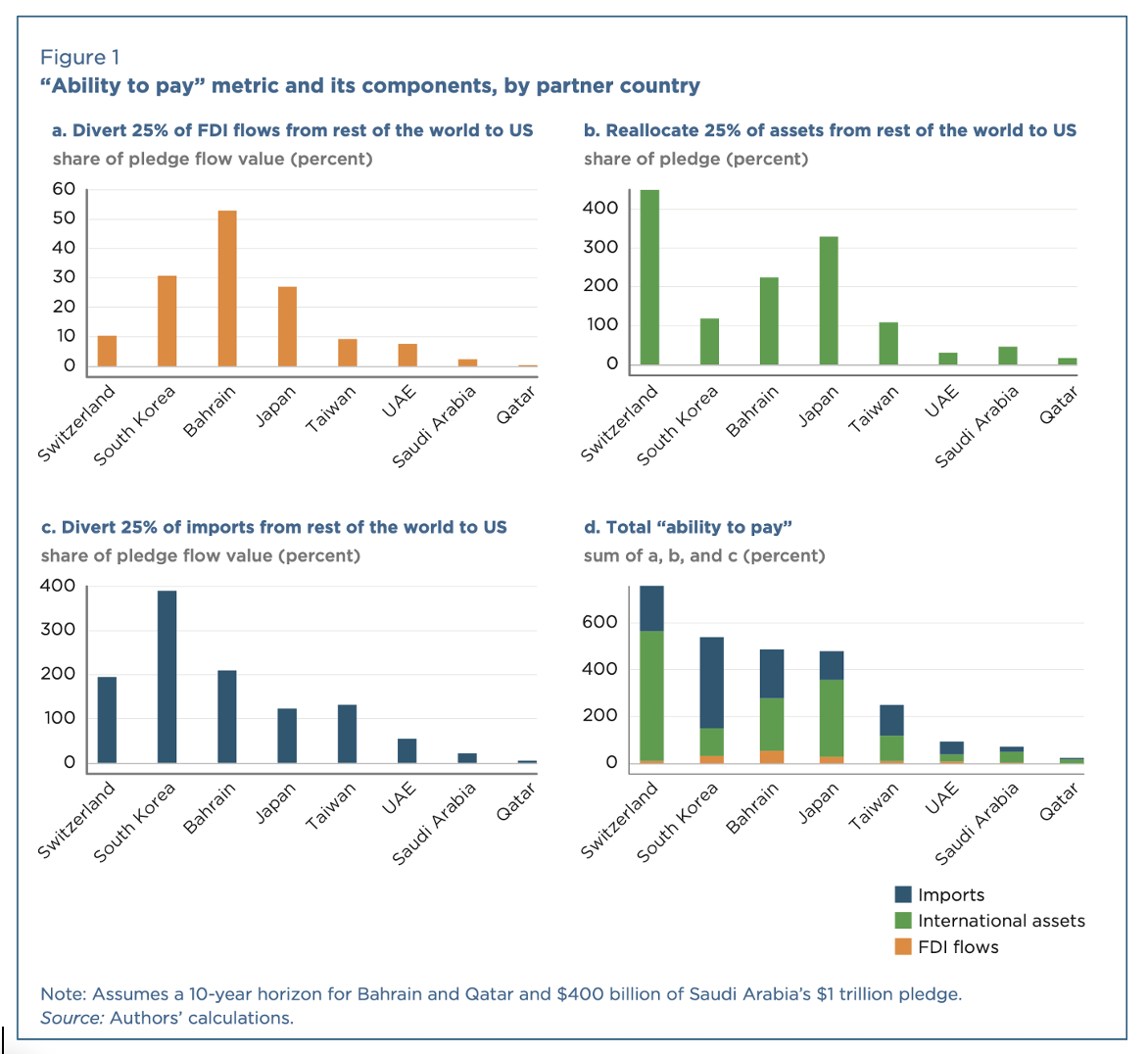

The America First investment pledges: How are they structured and are they realistic? The Peterson Institute for International Economics

In pursuit of President Donald J. Trump's "America First" agenda, the administration has pressured allies and partners to invest in US industrial and infrastructure projects. The White House has announced commitments by the European Union, Japan, South Korea, Taiwan, several Gulf Cooperation Council countries, and others, to import specific amounts of goods and services from the United States and to make sizable investments on US soil. These agreements resulted from a more coercive US foreign policy than in the past. Because the administration is helping select the targets of foreign investment, it is embarking on a major expansion of US industrial policy—one paid for by allied countries. This Policy Brief shows that much about investment pledges, worth more than $5 trillion, remains unclear or aspirational.

Making Industrial Strategy Great Again Foreign Affairs

The author argues that the Trump administration has embraced industrial policy in all the wrong ways. Instead of organizing policy around missions—explicit public goals that define the problem to be solved and the outcomes to be delivered—and then aligning the state’s tools to get there, it has treated industrial policy as a set of sector deals to be cut and announced. It has stripped away conditions on government support for private industry that could ensure the socialization of rewards. The government has taken a ten percent stake in the semiconductor manufacturer Intel for $5.7 billion in CHIPS Act funding; a 15 percent stake in the rare-earth mining and processing company MP Materials for a $400 million investment; a five percent stake in Lithium Americas, the company developing the Thacker Pass lithium project in Nevada, through loan restructuring; and a “golden share” in U.S. Steel, granting the government permanent veto power over headquarters relocation and production offshoring. But it is using these unprecedented equity stakes not to steer strategy or secure public value but to extract value retroactively. Industrial policy will fail, economically and politically, unless it is organized around clear missions to create public value. When the state socializes risks through public funding, the public must share in the rewards.

Economic Statecraft Is Back. Is America Ready? War on the Rocks

America still has enormous economic leverage. What it lacks is a plan. A new War on the Rocks series, launched with the Potomac Institute for Policy Studies, explores how economic statecraft should be organized, led, and integrated into defense planning.

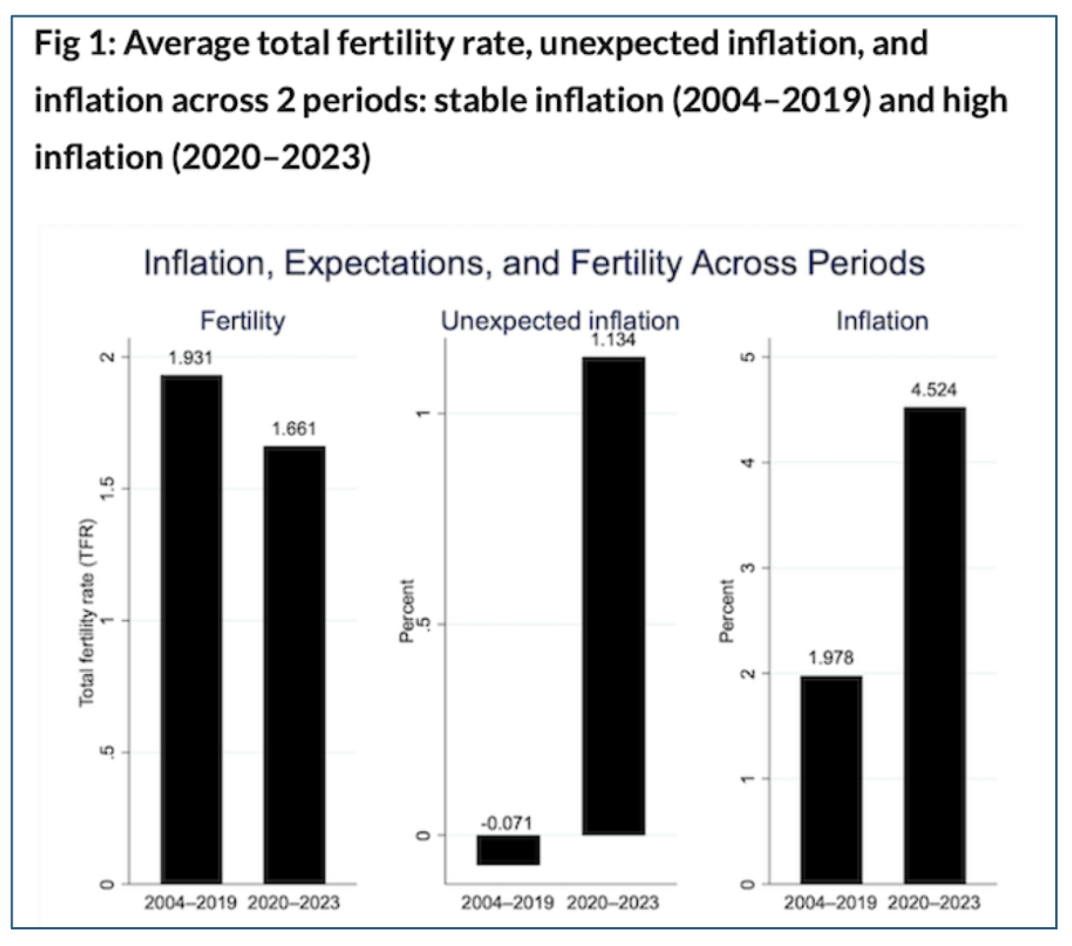

Inflation and Fertility in the United States Institute for Family Studies

Over the past several years, American households have experienced one of the sharpest increases in the cost of living in decades. Rising prices for housing, childcare, healthcare, and education have coincided with heightened economic uncertainty following the COVID-19 pandemic. At the same time, U.S. fertility rates have continued their long-run decline, prompting renewed debate about whether economic pressures are reshaping family formation decisions. While discussions often focus on cultural change or shifting preferences, the affordability of raising children in an era of elevated and unpredictable prices may be an underappreciated part of the story.

Our Annual Christmas Book Recommendations

Our apologies - We are a little late with our annual list, but hopefully you will find our recommendations both interesting and fun!

Woodrow Wilson: The Light Withdrawn by Christopher Cox (Simon & Schuster, 640 pages, 2024)

Growing up, Woodrow Wilson was lionized in the classroom, held up as a paradigm of enlightened leadership and vision. As the former President of Princeton University and New Jersey Governor, he was the man who helped negotiate the Armistice of World War I, pushed for the League of Nations (which, while failing in that form, led to the establishment of the United Nations decades later), and established the Federal Reserve. What we were never taught was that he was also a determined southern racist who advanced Jim Crow laws while doing all he could to deny women the right to vote - but who then flipped at the last moment to support women’s right to vote in return for further advancing Jim Crow laws. Cox, a former Member of Congress and Chair of the US Securities and Exchange Commission, has done an extraordinary amount of research in writing this book. I found it hard to put down.

Private Finance, Public Power: A History of Bank Supervision in America by Peter Conti-Brown and Sean Vanatta. (Princeton University Press, 424 pages, 2025)

On first blush, you may think this is not going to be the most scintillating of topics. But the authors bring to life the critical importance and historical impact of what keeps America’s finance machine running - or, at times, plays a role in crashing. Banks in America are private institutions with private shareholders, boards of directors, profit motives, customers, and competitors. And yet the public, Washington, and state policymakers play a key role in deciding which risks are taken, as well as how, when, and to what end. Conti-Brown and Vanatta examine how the US has managed financial risk and how it has evolved to become engaged in more social policy issues, such as monitoring racial discrimination, managing financial concentration, and, more recently and controversially, climate change. The book weaves in a large cast of historical characters who have played outsized roles in all of this, through the best of times, financial panics, and scandals.

I Deliver Parcels in Beijing by Hu Anyan, translated by Jack Hargreaves (Astra House, 336 pages, 2025)

A best-seller in China in 2023, Hu Anyan recounts his brutal, low-paying work as a parcel delivery worker with very little hope for a better life ahead. Straightforward and candid, Hu’s writing conveys the cultural shift in China where young people question the traditional work-for-success model and reflecting a society grappling with rapid economic change - more than hinting at the intense struggles inside China today as it grapples with internal political and economic challenges the West normally cannot see.

Mexico: A 500 Year History by Paul Gillingham (Atlantic Monthly Press, 752 pages, 2025)

Mexico has always been of special interest to me, and I have enjoyed reading about its history. When Gillingham came out with this mammoth new history - 752 pages - I was a bit intimidated and wondered if I would learn anything new. Happily, this is a brilliant, elegantly written book, and the author has done tremendous research. In short, I learned a lot. As the US begins a slow and likely arduous new round of trade negotiations with Mexico, it’s an essential contribution to understanding the enormous changes and upheaval Mexico has experienced over the last 500 years and why a lot of the changes still to come are going to be incredibly important not just there but to the US and the rest of the Western Hemisphere.

The French Revolution: A Political History by John Harman (Yale University Press, 384 pages, 2025)

We all know the basics of the French Revolution: Let them eat cake, uprisings in the streets, and off with their heads. But it was much more than that as this excellent history by John Hartman makes clear - and its ramifications are still being felt today in various ways. How and why did the ancien régime blow apart so fast and so violently? A great read.

1929: Inside the Greatest Crash in Wall Street History and How it Shattered a Nation by Andrew Ross Sorkin (Viking Press, 592 pages, 2025)

Sorkin’s history of the fateful stock market crash in 1929 is a fascinating and vivid read of how what was thought to be an unstoppable stock market spectacularly crashed, sending the US into a depression and forever changing the nation. Sorkin has done some fabulous research here, and in an age when we are debating crypto and AI bubbles, there are many lessons to be gleaned.

King of Kings: The Iranian Revolution: A Story of Hubris, Delusion and Catastrophic Miscalculation by Scott Anderson (Doubleday Press, 512 pages, 2025)

Scott Anderson (Doubleday, 512 pp., $35, Aug. 5)

President Trump’s recent bombing of Iranian nuclear facilities reminds us that the relationship between modern-day Iran and the US is a long and brutal one. Anderson takes readers back to when the troubles began in 1979, when the Shah of Iran was toppled. A great history and reminder of just how complicated and deadly the relationship has become and likely to remain for the foreseeable future.

Eclipsing the West: China, India and the Forging of a New World by Vince Cable (Manchester University Press, 352 pages, 2025)

Cable has an extensive and highly impressive career: Beginning as a development economist, chief economist at Royal Dutch Shell, member of the UK Parliament, Leader of the Liberal Democrat Party, and UK Minister for Business, Innovation, and Skills under Prime Minister David Cameron, and a minister in the UK coalition government under David Cameron. He writes a fascinating analysis of the increasingly tense relationship between the West and Asia, specifically China and India. Cable sees three possible future scenarios playing out: A democratic “Global West” confronting autocratic adversaries, led by a failing China, with India joining the democracies; or a multi-polar world, with a rising China and a rising India and no hegemon; or a multilateral world, with a reformed, but functional, postwar order and, again, no hegemon. Smartly written, it leaves the reader plenty to ponder about how all this will play out.

Recommended Weekend Reads

The National Security Implications of the US Industrial Base, China’s Ongoing Demographic Crisis, The US-Venezuelan Crisis and Bonds, and the Growing Global Debt Crisis

December 5 - 7, 2025

The US Industrial Base and National Security

Building Greater Resilience and Capacity in the US National Security Industrial Base Brookings Institution

In the current policy landscape, virtually every stakeholder—from federal agencies to industry groups—calls for classifying a widening swath of economic activity as “national security.” The impulse to broaden what counts as critical has gained momentum not only with each new global disruption, but also with each new report highlighting U.S. exposure to China in key sectors, making “national security” a catchall for fears that range from supply interruptions to cyber threats. While this instinct reflects real vulnerabilities, it leaves policymakers struggling to prioritize and risks making the label so expansive that it ceases to have sharp policy meaning. This paper cuts through that noise. We agree with the notion of expanding the concept of national security to include production supply chains, the interruption of which by a hostile foreign actor could directly imperil large numbers of American lives or the functioning of society. Our approach, however, is not simply whether to broaden the concept of national security, but how to realistically scope it—especially when it comes to supply chains.

The National Security Strategy of the United States of America 2025 The White House

On Friday, the White House released a report entitled “The National Security Strategy of the United States of America 2025.” In it, the report makes clear that securing access to critical supply chains and materials is of paramount importance to the Trump national security strategy, along with reindustrialization, balance of trade, and reviving the US’s Defense Industrial base.

Acquisition Reform vs. Congress: Who Will Win? War on the Rocks

Weeks ago, Secretary of Defense Pete Hegseth gave a speech announcing the Pentagon’s intentions to embrace more aggressive acquisition reforms. One of the most significant changes is to shift from a program focused acquisitions to portfolio concepts. According to Hegseth: “We will shift funding within portfolios’ authorized boundaries swiftly and decisively to maximize mission outcomes. If one program is faltering, funding will be shifted within the portfolio to accelerate or scale a higher priority. If a new or more promising technology emerges, we will seize the opportunity and not be held back by artificial constraints and funding boundaries that take months or even years to overcome.” But the biggest obstacle to shifting the Department of Defense to a portfolio management structure comes from congressional appropriators. Regardless of party affiliation, appropriators jealously guard their role as the arbiters of spending allocation in defense and other Federal roles. They have consistently opposed giving the Pentagon this degree of flexibility. A knock-down, drag-out fight between the Trump Administration and Congress now looms.

Latin America

The US-Venezuela relationship as seen through the price of an oil-linked bond Reuters

The ramp-up of U.S. pressure on Venezuelan President Nicolas Maduro's government is bringing fresh attention to the nation's defaulted bonds, including those of the state oil company Petroleos de Venezuela, known as PDVSA. Venezuela defaulted on its debt in 2017 but PDVSA continued to pay holders of a specific bond maturing in 2020. It was issued in 2016 under a swap offer that replaced debt maturing the following year. This bond is secured with a pledge of 50.1% of refiner Citgo Holding through PDVSA’s wholly-owned subsidiary PDV Holding. But payments stopped after the opposition-led National Assembly declared the bond contract illegal in October 2019.

The Hidden Cost of Your Avocado Ioan Grillo/New York Times

In recent years, Mexico’s cartels have diversified from drug production to a portfolio of criminal rackets, from human smuggling to stealing crude oil — and, increasingly, extorting civilians. The shakedowns, known here as “cobros de piso,” rob workers, from mom-and-pop shop owners to farmers to truck drivers, of their earnings and force up the prices of goods in Mexico and abroad. One business association estimates that such protection rackets cost Mexican enterprises around $1.1 billion this year as of September.

China’s Demographic Challenge

China's Demographic Dilemma Pekingology Podcast: On Chinese Politics/Center for Strategic and International Studies

In this episode of Pekingology, CSIS Senior Fellow Henrietta Levin is joined by Philip O’Keefe, Professor of Practice at the University of New South Wales Centre of Excellence in Population Ageing Research and one of the world's leading experts on demographic trends in China and across Asia. They unpack the rapid aging of Chinese society, exploring the impact of a shrinking population on China's politics, economy, and innovation ecosystem, as well as its trade imbalances and Beijing's global ambitions.

China Is Trying to Boost Fertility. It’s Not Working Rand Corporation

China's population is aging rapidly, and its birth rate is declining. These trends have resulted in a shrinking workforce and growing pressure on social services. In response, Beijing has rolled out a series of pronatalist policies. A new RAND study finds that these efforts have been unevenly implemented and largely ineffective. This shows the limits of government attempts to influence family decision-making. These findings have implications for the United States, where fertility rates are also declining. Rather than trying to increase the population's desire to have children, it may be more effective to help those who already want to grow their families. Such an approach might include removing structural barriers by improving access to affordable child care and housing. As the authors write, “The United States should learn from China’s failed pronatalist policy.”

Geoeconomics

The Global Debt Crisis Builds Robin Brooks Substack

Fed cuts aren’t pulling down long-term yields: if you look at the long end of the yield curve properly by stripping out front-end yields, things look very worrying. 10y10y and 10y20y forward yields are near their highs and the gap of both metrics with 10-year yield has grown. The buyers’ strike for longer-dated Treasury debt looks like it’s getting worse. There’s many idiosyncratic trouble spots: a key feature of the recent rise in long-term yields is that there’s many fiscally distressed countries that run into trouble at different points and for idiosyncratic reasons. Italy, France and the UK are all part of this dynamic and have very elevated 10y20y forward yields. Traditional safe havens are failing: in the past, Japan and Germany would have been safe harbors in this kind of environment, but these days they’re at the heart of the rise in long-term yields.

The State of Generative AI Adoption in 2025 Federal Reserve Bank of St. Louis “On the Economy” Blog

In September 2024, we presented results from the first nationally representative U.S. survey of generative AI adoption at work and nonwork settings, conducted in August 2024. Since then, we have conducted our survey—the Real-Time Population Survey—on a quarterly basis. In this blog post, we share an update on the state of generative AI adoption by U.S. workers and look for evidence of this technology’s impact in the broader economy.

Recommended Weekend Reads

What Next for Russian-Ukrainian Peace Talks? Russia’s Shadow War on Europe, The U.S.–Saudi Critical Mineral Deal, and the Great Reallocation in the U.S. Supply Chain Trade

November 28 -30, 2025

We hope you had a wonderful Thanksgiving holiday! Below are a number of reports and articles we read this past week and found particularly interesting. Hopefully, you will find them interesting and useful as well. Have a great weekend.

The Ukraine Peace Negotiations

Is there any peace deal that Putin would accept? Vox

In recent weeks, President Trump has offered a 28-point peace plan, which is now a 19-point peace plan. Hard bargaining is going on between the US, Ukraine, and the EU. But at this point, nobody seems to have any leverage over Russian President Vladimir Putin. Which is why the question of whether this war will end soon comes down to what terms Putin finds acceptable. This raises the depressing question of whether peace is possible at all as long as Putin is alive and in power.

A Ukraine Plan that Would Actually Work Hal Brands/Bloomberg Opinion

President Donald Trump’s new peace ploy in Ukraine will likely fail. He has a chance, in the coming months, to craft an approach that might succeed. Real peacemaking could be possible in 2026, because the strains on Russian leader Vladimir Putin’s economy and army are getting worse. But policymakers in the US, the European Union and Ukraine will have to overcome their own hesitations and weaknesses — or Putin will still be able to settle this war on his terms. But if this round of peacekeeping proves abortive, the next one could go better — if Ukraine and its supporters properly prepare. Putin seems confident that Russia is on the road to victory. Yet his position is weaker than it seems.

This Might be the best Ukraine can Hope For Jamie Dettmer/Politico EU

As it stands, there is scant grounds for optimism that, for all its heroism, Ukraine can turn things around. The country is unlikely to emerge from its most perilous winter of the war in a stronger position, better able to withstand what’s being foisted upon it. In fact, it could be in a much weaker state — on the battlefield, the home front, and in terms of its internal politics. Indeed, as it tries to navigate its way through America’s divisive “peace plan,” this might be the best Ukraine can hope for — or at least some variation that doesn’t entail withdrawing from the territory in eastern Ukraine it has managed to retain.

War Without End: Russia’s Shadow Warfare Center for European Policy Analysis

Even as Ukraine continues to suffer under wave after wave of bombardment and an ever-deepening occupation, Europe as a whole is under a sustained assault from Russia of a different kind. This report explains the who, what, why, and how of Russian shadow warfare, uncovering the nature of the forces Russia brings to bear against Europe itself, their governance structures, and, critically, the implicit doctrine that shapes strategic and tactical decision-making. This analysis shows that Russia’s shadow warfare is not simply a covert strategy, developed to take advantage of Western soft spots or fecklessness. Rather, it is the reflection of a deeper ideological and institutional logic, a neo-Stalinist threat framework that sees warfare as continuous and ubiquitous, that fuses domestic and foreign threats, and that understands everything and everyone as a potential target. This is an approach to warfare that generates escalation not by mistake, but by design. Unless Europe can impose discipline on the Russian shadow-warfare machine through clear deterrence, the likelihood of full-scale war between Russia and NATO will only increase.

The Americas

Russian Disinformation Comes to Mexico, Seeking to Rupture U.S. Ties The New York Times

Russia’s disinformation efforts across Latin America have intensified over the last two years, partly aimed at sowing discord between the United States and its allies in the region, according to an American diplomatic cable and new report by watchdog groups. The campaign is spearheaded by Kremlin-owned media outlets like Sputnik and RT, officials say, describing an effort to stoke anti-American sentiment, especially in Mexico, the world’s largest Spanish-speaking nation and Washington’s biggest trade partner.

With the USS Gerald R. Ford, the world’s largest aircraft carrier, positioned in the Atlantic, and Puerto Rico militarized with at least 5,000 of the nearly 15,000 troops mobilized for the operation, the specter of the Cold War — this time against drugs — seems to have resurfaced in the region, and Havana is beginning to worry. If Venezuela falls, Cuba would lose its most important point of reference in the Southern Cone at a time when Latin American democracies, with their electoral volatility, are transitioning from progressive governments — which could be potential allies — to right-wing governments. More than an economic loss, Cuba would lose an ideological and symbolic ally.

The Latest on the Global Race for Critical Minerals

What’s in the New U.S.–Saudi Minerals Agreement? Center for Strategic and International Studies

The visit by Saudi Crown Prince Mohammed bin Salman to Washington, D.C., marks a high-profile moment in the strategic partnership between the United States and Saudi Arabia. The visit represents a major step forward in the bilateral minerals’ relationship. The two countries established a Strategic Framework for Cooperation on securing uranium, metals, permanent magnets, and critical mineral supply chains, which is designed to facilitate two-way investment in this vital sector and serve as a "cornerstone" of the bilateral strategic partnership. Additionally, the U.S. Department of Defense (recently renamed the Department of War) also announced that it will finance a 49 percent equity stake in a new rare earths refinery in Saudi Arabia. Given the kingdom’s substantial reserves of heavy rare earth elements, this partnership between the Department of War, Maaden, and MP Materials will play a critical role in reducing dependence on China, particularly following a year of pronounced volatility in global access to heavy rare earths.

The Global South and China’s Mineral Power Jesse Marks/Rihla Research & Advocacy LLC

Abstract: This paper examines how Chinese scholars and policymakers interpret the accelerating contest over critical minerals and what it reveals about Beijing’s evolving approach to supply-chain power in the Global South. It shows how China increasingly views minerals as strategic assets foundational to national strength and industrial autonomy. Chinese analysts frame resource security as an integrated system that blends state-backed finance, diplomacy, and co-development with host countries to secure and diversify supply, while mitigating external pressure from U.S.- and EU-led “de-Sinicization” strategies. At the same time, they acknowledge China’s own vulnerabilities, defined as heavy import dependence, exposure to political risk in resource-rich states, and a global shift toward resource sovereignty that raises the bar for local processing, technology transfer, and joint ventures. The result is a more contested, politically charged mineral landscape in which Beijing seeks both secure access to mineral resources, as well as a more concerted effort to shape the rules, governance models, and industrial pathways of the next generation of mineral economies.

Geoeconomics

What Is a Tariff Shock? Insights from 150 years of Tariff Policy Regis Barnichon/Aayush Singh/Federal Reserve Bank of San Francisco

Widely touted by the White House, this paper looks at 150 years of tariff policy in the US and the estimates it has on macro aggregates. Starting in 1870, the study shows that a tariff hike raises unemployment (lowers economic activity) and lowers inflation. Using only tariff changes driven by long-run considerations—a traditional narrative identification—gives similar results. We also obtain similar results if we restrict the sample to the modern post-World War II period or if we use independent variation from other countries (France and the UK). These findings point towards tariff shocks acting through an aggregate demand channel.

Analyzing Japan’s $550 Billion Pledge to Invest in the U.S. Federal Reserve Bank of St. Louis

In July 2025, the United States and Japan reached a major trade agreement that includes Japan’s pledge to invest $550 billion in U.S. industries in return for lower tariffs on Japanese imports. The details of this investment pledge became clearer on Sept. 4, when U.S. Secretary of Commerce Howard Lutnick and Ryosei Akazawa, then Japan’s top trade negotiator, signed a memorandum of understanding (MOU). In practice, this structure makes Japan’s commitment resemble a loan rather than an equity investment, since Japan does not become a shareholder in the projects. The interest rate of this “loan” is called “deemed interest rate,” which is based on a benchmark rate plus a spread that depends on the project’s risk profile. Once the principal and accrued interest are fully repaid, Japan begins receiving returns through its 10% profit share. Nevertheless, it remains unclear what would happen if Japan were unable to fully recoup its deemed allocation amount. In that case, the “loan” would likely become unrecoverable, and Japan would have to write it off.

An Anatomy of the Great Reallocation in US Supply Chain Trade Laura Alfaro and Davin Chor National Bureau of Economic Research

Since 2017, China has experienced a large and persistent decline in its share of the US import market. The main gainers have been Vietnam, Mexico, and (more recently) Taiwan. It is well-documented that China’s share in US direct imports fell from around 21% in 2017 to 16% in 2022. Figure 3 reveals a further drop in the US import market share held by China to around 13% by 2024. The decoupling that started under the first Trump administration thus extended through to the end of the Biden presidency, rather than undergoing any reversal. Figure 3 further hints at how these large shifts in the sources of US imports have persisted post-Liberation Day. By July 2025, China’s share in US direct imports had fallen by another 4pp relative to 2024, declining from 13% to roughly 9%. To put this in perspective, China’s share in total US imports stood at approximately 9% in 2001, in its accession year to the WTO. This climbed steadily over the next 16 years, peaking at 22% in 2017. The drop back to a 9% import share by mid-2025 thus represents a remarkable unwinding, in just half the time it took this share to reach its pre-trade war peak.

The Predictability of Global Monetary Policy Surprises Federal Reserve Bank of Boston Research Working Paper

Surprise changes to short-term interest rates around central bank announcements—commonly termed “monetary policy surprises”—have been shown to be predictable using information available before the announcements. This is notable given the profit opportunity this predictability presents in such an important market. This paper investigates the predictability of monetary policy surprises in an international context. The author constructs a data set with monetary policy surprises across nine central banks—covering Australia, Canada, the euro zone, New Zealand, Norway, Sweden, Switzerland, the United Kingdom, and the United States—and around 2,000 announcements.

Recommended Weekend Reads

Understanding Trump’s Latin American Military Buildup, The Secret and Massive Drug Smuggling Routes into the US, Young Adults Are Spending Less Time Together, and The Desperate Search for Safe Havens

October 31 - November 2, 2025

Below are a number of reports and articles we read this past week and found particularly interesting. Hopefully, you will find them interesting and useful as well. Have a great weekend.

The Americas

Understanding Trump’s Military Buildup in Latin America Americas Quarterly Podcast

The recent deployment of the USS Gerald R. Ford, the U.S. Navy’s largest aircraft carrier, has intensified speculation about Washington’s true objectives in the Southern Caribbean. In this episode of the Americas Quarterly Podcast, we examine what’s really behind the Trump administration’s escalating military activity. Is it a hardline campaign against drug cartels, or the opening moves of a broader effort to pressure Venezuelan leader Nicolás Maduro? What do we know about dynamics within the Venezuelan military? And to what extent could this impact Washington’s relations with Colombia and other countries in the region? Our guest is Ryan Berg, director of the Americas Program and head of the Future of Venezuela Initiative at the Center for Strategic and International Studies.

From Posture to Purpose: Rethinking U.S. Strategic Aims in Venezuela FIU Jack D. Gordon Institute for Public Policy

The U.S. military buildup in the Caribbean reflects a strategic confusion between counter-narcotics and regime-change objectives in Venezuela. Current operations project power but lack coherence, risking escalation without achievable outcomes. A sustainable strategy must align U.S. means and ends, favoring intelligence, law enforcement, and targeted financial tools over military coercion. Even limited “surgical strikes” risk hardening regime cohesion, triggering regional instability, fueling migration flows, and creating governance vacuums with grave humanitarian consequences. To avoid these pitfalls while focusing on transnational criminal organizations, Washington should prioritize multilateral law-enforcement cooperation, expand Coast Guard and intelligence capabilities, and strengthen sanctions enforcement targeting the regime’s illicit revenue streams. Aligning coercive, diplomatic, and economic instruments toward realistic, proportional goals offers the only path to sustainable results without deepening Venezuela’s crisis on entangling the United States militarily.

After Argentina’s Midterms, a New Chapter for U.S.-Argentina Relations Center for Strategic and International Studies

Argentina’s midterms may also herald a new era of U.S. relations with the country and Latin America as a whole. In the weeks leading up to the election, the United States announced a major financial assistance package, giving Argentina access to a total of $40 billion in U.S. dollar currency swaps, with $20 billion coming from the U.S. Department of the Treasury’s Exchange Stabilization Fund, and a further $20 billion from banks and sovereign wealth funds. In addition to this, the Trump administration announced plans to purchase Argentine beef, a move that was deeply unpopular with U.S. ranchers but offered a powerful signal of the importance Washington places on its relationship with Buenos Aires

See the Secret Networks Smuggling Drugs to the U.S. From Latin America The Wall Street Journal

These interactive reports and accompanying maps show how demand in America for illegal drugs such as fentanyl and cocaine fuels sophisticated systems for smuggling them in. Traffickers deploy everything from fast-moving fiberglass boats to stealthy “narco-subs” to cargo ships to get their products to users without losing shipments to seizures or couriers to arrest. With decades of experience, according to U.S. counternarcotics officials, the traffickers are usually a step ahead of America and its allies in Latin American and Caribbean waters

Youth and Family Trends and Their Future Impact on the Economy

Cognitive Skills Beyond Childhood The Economic Journal

Data from a British birth cohort followed since 1958 show that cognitive skills early in life predict wages at age 50 better than cognitive skills at age 50. Early cognitive skills likely allow for higher educational attainment or on-the-job learning.

Young Adults Are Spending Less Time With Friends Institute for Family Studies

In post-pandemic America, young adults are spending a record amount of time alone. But even before the pandemic, young adults began spending less time with friends. In 2010, young adults ages 18 to 29 on average spent 12.8 hours a week with friends. By 2019, that number nearly halved, falling to 6.5 hours a week. The pandemic exacerbated this trend with a low point of 4.2 hours a week with friends in 2020. And while we’ve seen a slight increase since, socializing has not nearly recovered. Today, young adults spend just 5 hours a week with friends. Lingering effects of pandemic-era isolation are certainly at play, but the role of technology cannot be ignored.

Mind the Fertility Gap: Why people stopped having babies and how economic freedom can help Institute for Economic Affairs

n a new paper published by the Institute, British women are falling at least 0.4 children short of their own stated family goals, according to fertility data through 2011, with this gap likely widening as fertility now hits record lows of 1.44 while desired family size remains stable at 2.2. New report shows how pro-natal policies that focus on cash incentives, such as baby bonuses, subsidies, and maternity pay, may have some short-term effect but are often found wanting and prohibitively expensive. Evidence shows policies affecting economic freedom, including Labour market, childcare and housing liberalization, can have profound effects on fertility through their impact on work-family compatibility

Geoeconomics & Financial Markets

The Role of Single-Family Rentals in the U.S. Housing Market Federal Reserve Bank of St. Louis

When homeownership and home sales plummeted in 2010 in the wake of the housing market collapse, investors responded by purchasing single-family homes and renting them out to households that could not afford to buy such homes but still desired this type of housing. Subsequently, investor-owned single-family rentals (SFRs) increased as a share of total single-family properties, and they continue to increase as a housing supply shortage and higher mortgage rates make homeownership difficult for many first-time homebuyers. This blog post summarizes economic research that has been done on the role of investor-owned SFRs in the U.S. housing market. Such research has found that the vast majority of SFRs are owned by small-scale investors. Properties owned by large-scale investors tend to increase prices of nearby homes, while ownership by small-scale investors appears to have the opposite effect. Research has also found that investor-owned SFRs expand housing options available to renters but may negatively impact renter welfare in terms of eviction filings4and rent increases.

The Desperate Search for Safe Havens Robin Brooks Substack

Countries with low debt burdens are outperforming ones with lots of debt. The right chart above shows this dynamic. Since Jackson Hole, the Swedish Krona (red line) is the best performing currency against the Dollar, followed by the Norwegian Krone (orange line) and Swiss Franc (black line). The Euro (pink line) is flat against the Dollar, no surprise since it consists mostly of high-debt countries, with Germany’s recent move to soften up its debt brake and pursue big fiscal stimulus a major destabilizer for the region. The Japanese Yen (blue line) is down over two percent against the Dollar, no surprise given that gross government debt is 240 percent of GDP. The fact that Sweden is at the top of the pack makes sense. The Krona is massively undervalued (it’s at the same level against the Euro as during the global financial crisis), while Sweden has also managed to steer clear of endlessly rising debt levels that so bedevil the Euro periphery.

As New Jobs In Finance Dry Up, New York City’s Fiscal Model Is Wilting The Economist

According to the Citizens Budget Commission New York state’s share of American taxpayers reporting more than $1m in income declined from 12.7% in 2010 to 8.7% in 2022. Such people paid $34bn in income tax to the state and city in 2022, a figure that would have been $13bn higher if New York’s share of millionaires had held up. Estimates from Goldman Sachs suggest that fully 10% of households in New York City with incomes of more than $10m established residency elsewhere between 2018 and 2023. As the ultra-rich have headed for the exit, the city’s employment growth has become concentrated in much worse-paid industries than finance. Since the end of 2019, New York has added more than 268,000 jobs in health care and social assistance, particularly home health care. Employment as a whole rose by just 220,000 over the same period, meaning that, if it was not for that industry, overall employment would have shrunk.

Recommended Weekend Reading

Looking at U.S. - China Policy Challenges in Advance of the Xi-Trump Meeting, Will the AI Data Center Boom Threaten the Trump Manufacturing Revival?, and Looking at the Supply Chain Chokepoints in Quantum

October 24 - 26, 2025

Below are a number of reports and articles we read this past week and found particularly interesting. Hopefully, you will find them both interesting and useful. Have a great weekend.

A Look at Major Policy Issues for Both the U.S. and China

China’s Two Economy Problem Semafor

At a glance, China’s export-focused manufacturing sector is buoyant, racing away from the US and other advanced economies in areas including batteries, robotics, and biotechnology. And yet its domestic economy is in deep crisis, suffering from spiraling levels of joblessness, plunging consumer confidence, and falling business investment in the midst of a real estate collapse. To understand China is to believe all these things to be true. It is an economy moving fast and slow at the same time, a tech superpower that creates opportunities for PhD scientists but not its underclass of rural workers, a nation that manufactures a third of everything made in the world but can’t stir demand at home. Its growth model is so lopsided it is unbalancing the global economy. In short, China is at war with itself; taking the long view, the current US-China trade spat is a sideshow.

How China Raced Ahead of the U.S. on Nuclear Power New York Times

While U.S. nuclear construction costs skyrocketed after the 1960s, they fell by half in China during the 2000s and have since stabilized, according to data published recently in Nature. (The only two U.S. reactors built this century, at the Vogtle nuclear plant in Waynesboro, Ga., took 11 years and cost $35 billion.) China’s nuclear companies build only a handful of reactor types, and they do it over and over again. That allows developers to perfect the construction process and is “essential for scaling efficiently,” said Joy Jiang, an energy innovation analyst at the Breakthrough Institute, a pro-nuclear research organization. “It means you can streamline licensing and simplify your supply chain.”

Taiwan Is Not for Sale David Sacks/Foreign Affairs

When U.S. President Donald Trump meets with Chinese leader Xi Jinping in the coming weeks and months—likely starting next week at the Asia-Pacific Economic Cooperation forum in South Korea—the immediate focus will be on how to de-escalate the latest round of export restrictions and tariff threats that the United States and China have wielded against each other. But Trump and Xi are also likely to consider a more ambitious deal to reset bilateral relations, which would seek not only to stabilize economic ties but also to reevaluate geopolitical flash points—above all, Taiwan.

How U.S. Can Outcompete China Daniel Bob/RealClearWorld

Leadership in critical technologies such as artificial intelligence, quantum computing, semiconductors, robotics, advanced materials, biotechnology, and aerospace will determine who leads the world economically and strategically in the decades ahead. These technologies spur productivity gains, provide supply chain resilience, and shape military strength that sustain national security and prosperity.

China Against China Jonathan Czin/Foreign Affairs

Thirteen years after Xi Jinping ascended to the top of China’s leadership hierarchy, observers in Washington remain deeply confused about how to assess his rule. To some, Xi is the second coming of Mao, having accumulated near-total power and bent the state to his will; to others, Xi’s power is so tenuous that he is perpetually at risk of disgruntled elites ousting him in a coup.

Technology, Trade, Immigration, and Geopolitical Power

The Fiscal Impact of Immigration The Manhattan Institute

Using a methodology aligned with the congressional budget window, this report estimates the fiscal, economic, and population effects of immigrants by age, education, and category of admission. It updates previous Manhattan Institute research by incorporating more recent census data, more precise life-expectancy and fertility adjustments, economic and capital stock growth, and the fiscal effects of the descendants of immigrants. This report estimates fiscal impact in nominal dollars over a 10- and 30-year horizon. This report also updates and fixes several assumptions from previous research on the fiscal impact of immigrants, including the calculation method for interest on the debt and correctly adjusting tax credits for inflation. It uses an updated method for accounting for public-goods spending. Overall, the average new immigrant reduces the federal budget deficit and expands the economy, but this is not true of all categories of immigrants. Immigrants without college degrees receive more government benefits than they pay in taxes, even when we consider only their preretirement years. By contrast, immigrants who finished college or obtained an advanced degree contribute millions of dollars more in federal taxes than they receive in government benefits, and they save substantial amounts of interest on the debt while growing the economy.

AI Data Center Boom Threatens Trump’s Manufacturing Revival Bloomberg

The AI boom is coming to America’s industrial heartland, which speaks to how the economy is being transformed—even propped up—by a surge in investment in software, chipmaking and data centers. But the Lordstown plant’s reinvention raises the question: Is the exuberance around the technology that Trump has enthusiastically endorsed getting in the way of his goal of making America great again at churning out things like gasoline-powered cars, steel and furniture? Access to capital, power and people is key to the success of any construction or manufacturing project—and right now AI is gobbling up all three.

The Supply Chain Chokepoints in Quantum War on the Rocks

As quantum technologies move from proof-of-concept to deployment, supply chain resilience becomes just as critical as qubit coherence times. Resilience includes redundancy, domestic capacity, and timely alternatives when foreign manufacturers face disruptions or reprioritize their customers. Expertise and capital are key to driving technological innovation, but mean little if a company or research lab does not have access to the necessary inputs and reliable supply chains. Lack of access to one aspect of the supply chain can grind further research and development to a standstill, a red flag for investors and potential researchers. If the United States is to remain on the leading edge of quantum technologies, ensuring companies, government labs, and academic projects can consistently access critical supplies is a prerequisite.

Recommended Weekend Reads

China’s New Latin American Playbook, Russia’s Increasingly Desperate Search for Soldiers, Who Will Succeed Xi as China’s Next President?, and Geopolitical Implications of the Race for 6G

October 17 - 19, 2025

Below are a number of reports and articles we read this past week and found particularly interesting. Hopefully, you will find them of interest and useful as well. Have a great weekend.

Latin America

China’s New Playbook for Latin America Americas Quarterly

China has entered a new phase in its engagement with Latin America. It is one still characterized by extensive resource-seeking and market-seeking activity, features of the relationship for more than three decades now. As China invests and trades in Latin American raw materials and builds markets across the region for everything from its toys and textiles to ultra-high-voltage transmission lines and cloud services, overall trade continues to rise. At the same time, the relationship is rapidly evolving toward a more targeted, strategic approach. For all the recent attention given to China’s signature Belt and Road Initiative (BRI) infrastructure projects, Latin America’s relative share of investments under the plan is falling for the third consecutive year. The region received a little more than 1% of Beijing’s global BRI construction spending and 0.4% of outbound investment in the first half of 2025. Growth in Chinese foreign direct investment (FDI) in the region is also slowing. Whether those trends hold remains to be seen. But the days of Beijing showering the region with loans and large-scale infrastructure projects may be over, or at least diminished, replaced by more deliberate engagement and a focus on specific sectors of Chinese interest, especially at the higher end of the value chain.

How China’s Energy Investments Provide Durable Influence in South America Henry Zeimer/Center for Strategic and International Studies

China’s growing presence in South American energy generation and distribution has largely gone underreported, even as it risks placing critical infrastructure under foreign influence. Properly grasping the nature of this influence is of particular importance as the United States finds itself in the midst of a shift to a more competitive stance in its foreign policy approach in the Western Hemisphere.

What Is Mexico’s Amparo Reform? Everything You Need to Know Moments in Mexico

Mexico’s democracy is again on the precipice of a key inflection point. This time, it entails the Sheinbaum administration’s efforts to reform the amparo, a tool of the Mexican legal system that grants individuals the right of redress in the case of constitutional and/or human rights violations. There is no direct counterpart to the Mexican amparo in the United States; however, its functions are roughly carried out through a combination of civil rights litigation, judicial review, injunctions, and the writ of habeas corpus. The amparo and associated processes are complex. This piece is intended to provide a cursory overview and highlight the changes that the Sheinbaum administration seeks to impose.

Russia

Putin Seeks More Foreign Fighters Amid Mounting Russian Losses in Ukraine Atlantic Council

As Russia’s full-scale invasion of Ukraine approaches the four-year mark, Moscow is facing increasing difficulties replenishing the ranks of its invading army. With fewer Russians now prepared to volunteer, the Kremlin is seeking to recruit more foreign fighters to serve in Russian President Vladimir Putin’s colonial war. A number of recent media reports have highlighted the growing role of foreign nationals in the Russian military. In early October, an Indian citizen was captured by Ukrainian forces while fighting for Russia. The 22-year-old claimed to have been arrested in Russia while studying and pressured into signing a contract with the Russian army in order to secure his release from prison. After just two weeks of basic training, he was sent to the front lines of the war in Ukraine. Also in early October, the Los Angeles Times reported that Russia may have recruited tens of thousands of foreign fighters via social media, with many coming from disadvantaged countries across the Middle East, Africa, and East Asia. The article detailed how many of these recruits are allegedly enticed with offers of generous benefits including large salaries and Russian citizenship in exchange for military service in non-combat roles. In practice, however, most are soon sent straight into battle.

The Shooting Party: Russia’s Evolving Threat Perceptions Since 2002 Center for Naval Analysis (CNA)

In this paper, the authors examine how Russian military thinkers interpret and operationalize the threat perceptions defined by the country’s political leadership. Despite nearly four years of war in Ukraine, Russian security concerns regarding US military capabilities remain largely unchanged. Russian military thinkers continue to perceive US ballistic missile defense and Prompt Global Strike programs as the main threats to Russia’s security, believing these programs to be designed to degrade Russia’s retaliatory strike capabilities. The war in Ukraine has exposed gaps in Russia’s military capabilities, heightening Russian anxiety about the military contingents from the North Atlantic Treaty Organization (NATO) in the Baltic and Black Seas, particularly potential US deployments to Finland and Sweden. Viewing the substantial US and NATO military assistance to Ukraine as part of a broader strategy to weaken Russia, Russian military thinkers are particularly alarmed by Ukrainian offensive operations within Russian borders or those that target mainland Russia. Russian military thinkers believe that the United States and NATO are preparing for a long-term confrontation with Russia, which reinforces their views on the importance of maintaining and enhancing Russia’s strategic deterrence capabilities.

·Russia’s Crime-Terror Nexus: Criminality as a Tool of Hybrid Warfare in Europe GLOBSEC/International Centre for Counter-Terrorism

This report takes stock of Russian hybrid warfare in Europe in the context of its war of aggression against Ukraine. While doing so, it offers more than a catalogue of kinetic incidents attributed to Moscow. The report shows the extent to which criminality – whether through direct reliance on criminals to conduct attacks or through the “spook-gangster” nexus – constitutes a central pillar of Russia’s hybrid warfare. It opens with an overview of the phenomenon and traces Russia’s experience with hybrid tactics back to at least the 1920s. It then explores Moscow’s enduring use of criminality as a tool of domestic control and foreign policy, with particular emphasis on the post-2022 period.

China

Xi Jinping's Successor and the Future of China The Foreign Affairs Interview Podcast

When Xi Jinping took over the Chinese Communist Party in 2012, he began a new chapter in China’s history—one that would come to be defined above all by his grip on power. Xi overhauled not only the CCP but also China’s economy, military, and role in the world. Yet no matter how secure his power may be—and no matter his recent hot-mic musings about living to 150—what comes after Xi, and how it comes, is an increasingly central question in Chinese politics. As the political scientists Tyler Jost and Daniel Mattingly wrote recently in Foreign Affairs, “For any authoritarian regime, political succession is a moment of peril . . . and for all its strengths, the CCP is no exception.” And that’s not just a risk for the future. The uncertainty and the jockeying that the succession question spurs is already starting to shape China’s present. To Jost and Mattingly, there’s more at stake than just the matter of who will follow Xi. They note: “The drama created by a struggle over the succession . . . is unlikely to stay inside China’s borders.” They joined Deputy Editor Chloe Fox to discuss the nature of Xi’s rule, his attempt to define his legacy, and what that will mean for China in the coming months, years, and decades.

Stabilizing the US–China Rivalry Rand

The geopolitical rivalry between the United States and China embodies risks of outright military conflict, economic warfare, and political subversion, as well as the danger that tensions between the world's two leading powers will destroy the potential for achieving a global consensus on such issues as climate and artificial intelligence. Moderating this rivalry, therefore, emerges as a critical goal, both for the United States and China and for the wider world. The authors of this report propose that, even in the context of intense competition, it might be possible to find limited mechanisms of stabilization across several specific issue areas. They offer specific recommendations both for general stabilization of the rivalry and for three issue areas: Taiwan, the South China Sea, and competition in science and technology.

Geoeconomics, Technology, Global Food Policy, and Dealing with Student Absenteeism

6G isn’t about speed. It’s about sovereignty The Strategist

The race to 6G isn’t just about bandwidth. It’s about control over spectrum, standards, supply chains, and the values underpinning tomorrow’s infrastructure. If 5G taught us anything, trust and interoperability need to be built in from the start. The Indo-Pacific is already the world’s most contested connectivity environment. Through submarine cables, cloud platforms, and national 5G rollouts, governments are already making decisions that will shape how their citizens communicate, how their economies function, and who sets the rules. The shift to 6G only sharpens that contest. Reporting from the Financial Times makes clear that China is moving fast. Beijing is systematically excluding European vendors from its domestic telecommunications networks. Ericsson and Nokia, already reduced to a 4 percent market share, now face opaque security reviews that stretch for months. The message is that foreign firms aren’t welcome, while domestic vendors are being positioned as the only trusted suppliers for national infrastructure. They are backed by policy, shielded from competition, and expected to dominate the market at home and abroad.

Why Have Inflation Expectations Surged Recently? A Historical Perspective Federal Reserve Bank of Boston

Average near-term household inflation expectations in the Michigan Survey of Consumers have peaked higher than 8% four times in the past 60 years: twice in the 1970s, during the 2021-2022 post-pandemic inflation surge, and since spring 2025. Coincident sharp increases in gas and food prices, along with underlying broad-based inflation, explain a large share of the 2021-2022 spike in inflation expectations; those factors also accounted for about two-thirds of the 1973-1975 surge. The 1978-1980 increase in inflation expectations was much larger than the increase that rising prices usually would imply, consistent with the de-anchoring of inflation expectations at that time. Rising prices can barely explain the 2025 surge observed in the Michigan Survey of Consumers, which may signal that the risk of de-anchoring is larger than it was in the pre-pandemic period.

Is the U.S. in an Above-Target Inflation Regime? Federal Reserve Bank of St. Louis

Since January 2012, the Federal Reserve has adopted an explicit target of 2% inflation, measured as the 12-month change in the personal consumption expenditures (PCE) price index.1 And yet, after several years of below-target inflation prior to the COVID-19 pandemic, inflation rose above 2% annually in March 2021 and has persisted above 2% ever since. According to the latest data available (August 2025), inflation remains significantly above target, at 2.7%. In previous blog posts, I have analyzed these dynamics and their likely origin. In this blog post, my analysis suggests that we may be in a persistent above-target inflation regime.

The Challenge to Feed the World in the 21st Century: Useless, Harmful, and Helpful Policies American Enterprise Institute

Hunger, malnutrition, and food insecurity remain significant global problems, but instead of working toward solutions, Western governments are implementing policies guaranteed to reduce food production. Environmental benefits often attributed to policies that support biofuels, organic agriculture, land conservation programs, and similar strategies appear to be moderate or disappear once their impacts on the conversion of forested lands to agriculture are considered. The United Nations and the European Commission propose reducing food loss and waste and eating fewer animal products as strategies to combat food scarcity, but neither approach would likely be effective. To address world hunger, malnutrition, and food insecurity, the United States and other rich countries must stop enacting policies and supporting production practices that reduce agricultural yields, divert production from food to fuel, and encourage the conversion of forested lands to agricultural production across the world.

Need Not Be a Surprise: Early-Warning Systems for Chronic Absenteeism Nat Malkus/Sam Hollen – American Enterprise Institute

The COVID-19 pandemic drove up chronic absenteeism in nearly every school and student demographic, making district leaders’ task of targeting resources difficult. Whom do you help when every student is a candidate? Existing work shows that it is possible to predict absenteeism in advance, but past approaches are largely proprietary or hard for district leaders to use. We present a series of early-warning systems, starting very simple and adding complexity, with district leaders’ needs and constraints in mind.

Recommended Weekend Reads

Listen to Venezuelan Opposition Leader Machado Learn She Has Won the Nobel Peace Prize, Preparing for Putin’s Death, How Ukraine has Crippled Russia’s Oil Lifeline, Where Could Reshoring Manufacturers Find Workers?

October 10 - 12, 2025

Each week, we gather up the best research and reports we have read in the past week and pass them on to you. Below is this week’s curated collection. We hope you find them interesting and informative, and that you have a great weekend.

Latin America

“Oh my God… I have no words.” Listen to the emotional moment this year’s laureate, Maria Corina Machado, leader of the Venezuelan democracy movement, finds out she has been awarded the Nobel Peace Prize. Kristian Berg Harpviken, Director of the Norwegian Nobel Institute, shared the news with her directly before it was announced to the world.

Escalation Against the Maduro Regime in Venezuela: Puerto Rico’s Emerging Role in U.S. Power Projection Center for Strategic & International Studies

The United States is overseeing a seismic reordering of defense priorities and assets to the Western Hemisphere. At the time of this writing, four destroyers, one cruiser, one nuclear-powered attack submarine, one landing helicopter dock, two amphibious vessels, and one special operations platform, alongside a host of enablers and support vessels, are present in the Caribbean. In total, more than 10 percent of all deployed U.S. naval assets are currently located in the SOUTHCOM area of responsibility. These forces are more than a mere show of force; since the first warships entered the region in August, the U.S. military has conducted at least four lethal strikes against alleged drug trafficking boats in international waters, killing at least 21. The next phase of operations could witness strikes within Venezuelan territorial waters or even on land. Reportedly, the Trump administration has already drawn up strike packages for such contingencies, which are currently being reviewed by the president. Meanwhile, President Donald Trump has notified Congress of his determination that the United States is involved in a “non-international armed conflict” against drug trafficking groups now designated as foreign terrorist organizations, suggesting that the tempo of operations will only increase in the coming weeks.

Understanding Trump’s Shift on Brazil Americas Quarterly

Donald Trump’s Brazil strategy was not working. Instead of helping former President Jair Bolsonaro avoid prison or be allowed to run again in 2026, a barrage of U.S. tariffs and sanctions was having the opposite effect—hastening Bolsonaro’s conviction while boosting the popularity of his rival, President Luiz Inácio Lula da Silva. Brazil’s economy seemed to handle the strains surprisingly well, while a procession of business leaders to the White House in recent weeks warned of risks to U.S. inflation from coffee, beef, and other goods. So the U.S. president did what he has on other occasions: He listened. And then he changed course. Trump’s brief encounter with Lula at the United Nations, after which he proclaimed they had “excellent chemistry,” was not a chance meeting. And then they had a phone call. What comes next?

Russia

Preparing for Putin’s Death The Rand Corporation

Vladimir Putin is the longest-serving Russian ruler since Joseph Stalin. He turns 73 on Oct. 7, old for a Russian, but even if he is fanatical about his health, he cannot continue indefinitely. It is essential to consider who might succeed him. This is a challenging task—under Putin's rule, the Russian political system has, once again, become an authoritarian dictatorship bearing some of the features of a personality cult. Under these conditions, Putin has not, as far as we can tell, been publicly grooming a successor, presumably because his personal authority would begin to ebb to them, and because they would become a target for others who fear losing their influence.

How Russia Recovered Dara Massicot/Foreign Affairs

The story of Russia’s invasion of Ukraine has been one of upset expectations and wild swings in performance. At the start of the war, most of NATO saw Russia as an unstoppable behemoth, poised to quickly defeat Ukraine. Instead, Russia’s forces were halted in their tracks and pushed back. Then, outside observers decided the Russian military was rotten, perhaps one counterattack away from collapse. That also proved incorrect—Ukrainian offensives failed, and Moscow resumed its slow advance. Now, plenty of people look beyond Russia to understand the state of the battlefield, blaming Kyiv’s troubles on insufficient external backing instead. What many policymakers and strategists have missed is the extent to which Moscow has learned from its failures and adapted its strategy and approach to war, in Ukraine and beyond. Today, the military is institutionalizing its knowledge, realigning its defense manufacturers and research organizations to support wartime needs, and pairing tech startups with state resources.

Ukraine’s Drone War Is Crippling Russia’s Oil Lifeline National Security Journal

Ukraine’s expanding long-range drone fleet has knocked nearly 40% of Russia’s oil refineries offline. According to an analysis by BeefeaterFella, with refined fuels yielding far higher margins than crude, Russia could be losing $3–6 billion annually in revenue, while shortages, rationing, and black markets spread at home. Since January, 21 of Russia’s 38 major refineries have been struck, with successful Ukrainian attacks already 48% higher than in all of 2024, according to the BBC. The cascading effects are being felt far from the battlefield. Owners of small petrol stations in Siberia told Russian media they were forced to close due to supply shortfalls, with one manager in Novosibirsk comparing the crisis to the hyperinflation of post-Soviet Russia.

Trade, Tariffs, and Reshoring of Manufacturing

Where Could Reshoring Manufacturers Find Workers? Federal Reserve Bank of Cleveland