Fulcrum Perspectives

An interactive blog sharing the Fulcrum team's policy updates and analysis.

Recommended Weekend Reads

What Does Russia’s Inability to Support Its Allies Mean for Its Own Future?, The Massive Industrial Challenge To Modernize the U.S. Navy, Was Pandemic Fiscal Relief Effective Stimulus? And An Assessment of China’s Military Buildup

January 16 - 18, 2026

Below are a number of reports and articles we read this past week and found particularly interesting. Hopefully, you will find them interesting and useful as well. Have a great weekend.

The Future of Russia

Putin’s great-power project faces the ‘end of an era’ Politico EU

Moscow was also seemingly unable to protect its closest friend in South America earlier this month when the United States captured Venezuela’s Nicolás Maduro, a leader who had dutifully made the trip to Moscow for Putin’s Victory Day Parade in May last year. Embarrassingly, Moscow wasn’t even able to fend off the unprecedented U.S. seizure of an oil tanker flying a Russian flag. Just a year ago, Putin signed a 20-year strategic partnership agreement with Tehran. Now the regime — which supplied Russia with killer Shahed drones for its fight in Ukraine — is in danger of being toppled by protesters whom Trump has indicated he could intervene militarily to defend. Russians have taken notice. “An entire era is coming to an end,” wrote a pro-war military blogger under the pen name Maxim Kalashnikov on Sunday, reflecting growing criticism of the Russian leadership.

Russia Is the World’s Worst Patron Foreign Affairs

For the last 20 years, Moscow has demonstrated an ability to inject itself as a player in regions with strong anti-American sentiment. But the Kremlin’s costly adventures have yet to show any practical benefits for enhancing Russia’s genuine security interests or boosting its economic prosperity. Involvement in places such as Venezuela serves only Putin’s vanity, a few votes of solidarity with Moscow at the UN General Assembly, and money-making opportunities for corrupt Russian officials. The result has been that from Syria to Venezuela to Iran, Putin has overpromised and underdelivered.

Why Didn’t the Ukraine War Turn Russia’s Ruling Class Against Putin? Carnegie Politka

The answer is that Russia’s ruling class is disillusioned and fragmented. And, as the writer points out, the apparent suicide of the dismissed transport minister Roman Starovoit in 2025 was a reminder of the fragility of everyone’s position. For another, the idea that had brought together much of the establishment, “autocratic modernization”—that despite the authoritarian system, a rational state, capable of learning lessons and balancing interests, could still emerge in Russia—has obviously turned out to be a failure.

The Massive Challenge to Modernizing the U.S. Navy

Helming A Sea Change: Building The Future Workforce For US Shipbuilding McKinsey & Company

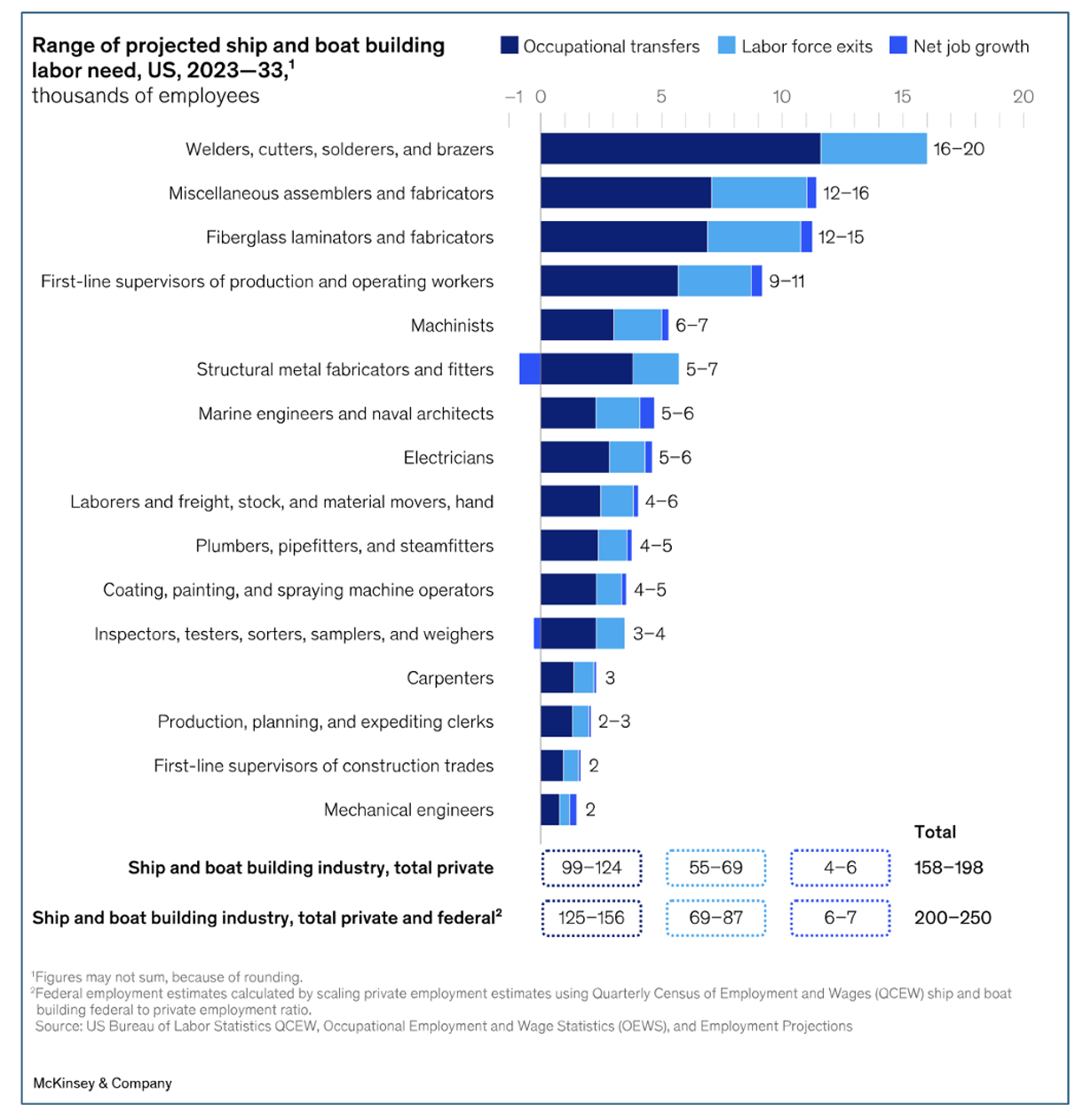

According to the US Department of Labor, the shipbuilding industry may require about 200,000 to 250,000 additional maritime workers in critical occupations, such as welding, soldering, and front-line management, to satisfy demand over the next decade. If demand for ships increases, the labor gap will be even wider.

Outlining the Challenges to the U.S. Naval Shipbuilding Center for Strategic and International Studies

Growing the size of the Navy has been a bipartisan goal of successive administrations and Congress over the last decade. The service faces capacity limitations as it struggles to meet the demands of its current aggressive operational tempo with a fleet that is small by historical standards and faces delays in conducting maintenance. The demand to increase the Navy’s ship count has only grown as China’s navy has overtaken the U.S. fleet in terms of size, with the blistering rate of production of its own shipbuilding industry. Despite the Navy’s plans for growing the fleet and bipartisan efforts and funding from Congress, the U.S. shipbuilding enterprise—including the Navy, Department of Defense (DoD), Congress, and industry—has failed to consistently produce ships at the scale, speed, and cost demanded. These longstanding challenges stem from a series of interwoven, systemic issues within both the U.S. government and industry, as well as broader socioeconomic trends. This report outlines the challenges facing the U.S. naval shipbuilding enterprise, their underlying drivers, and some efforts the government has taken to mitigate them.

Geoeconomics and Technology

Was Pandemic Fiscal Relief an Effective Fiscal Stimulus? Evidence from Aid to State and Local Governments Journal of Macroeconomics

Abstract: We use an instrumental-variables estimator reliant on variation in congressional representation to analyze the macroeconomic effects of federal aid to state and local governments during the COVID-19 pandemic. Through December 2022, we estimate statistically insignificant impacts of federal aid on employment. Our baseline point estimate suggests that $603,000 were allocated for each state or local government job-year preserved, and the bounds on our baseline confidence interval rule out estimates smaller than $220,400. Our estimates of effects on aggregate income and output are centered on zero and imply modest, if any, spillover effects onto the broader economy.

When Trade Compresses: The Impact of Liberalization on Wage Inequality Federal Reserve Bank of Cleveland

Abstract: We study the effects of trade liberalization on the full wage distribution, exploiting Spain's 1993 entry into the European Single Market. Using employer-employee data, we identify the causal effects of trade across the entire wage distribution, using a novel shift-share instrument embedded in an unconditional quantile regression. We find that the liberalization reduced wage inequality, leading to wage compression through earnings gains at the bottom of the distribution and wage losses at the top. We trace this compression to two asymmetric channels: import competition disproportionately harmed high earners, while export opportunities benefited low earners. The key mechanism is an import-driven “skill-downgrading.” A multi-region multi-sector model shows that the key insight for understanding these empirical results is that trade's distributional effects depend on the skill intensity of a country's tradable sector, and Spain's was relatively low-skill-intensive back then.

Foreign Affairs: The Myth of the AI Race Colin Kahl/ Foreign Affairs

In July, the Trump administration released an artificial intelligence action plan titled “Winning the AI Race,” which framed global competition over AI in stark terms: whichever country achieves dominance in the technology will reap overwhelming economic, military, and geopolitical advantages. As it did during the Cold War with the space race or the nuclear buildup, the U.S. government is now treating AI as a contest with a single finish line and a single victor. But that premise is misleading. The United States and China, the world’s two AI superpowers, are not converging on the same path to AI leadership, nor are they competing across a single dimension. Instead, the AI competition is fragmenting across many domains, including the development of the most advanced large language and multimodal models; control over computing infrastructure such as data centers and top-of-the-line chips used to train and run models; influence over which technologies and standards are used throughout the world; and integration of AI into physical systems such as robots, factories, vehicles, and military platforms. Having an edge in one area does not automatically translate into an advantage in the others. As a result, it is plausible that Washington and Beijing could each emerge as leaders in different parts of the AI ecosystem rather than one side decisively outpacing the other across the board.

China’s Military Capability

Annual Report to Congress: Military and Security Developments Involving the People’s Republic of China 2025 U.S. Department of Defense

Abstract: China’s historic military buildup has made the U.S. homeland increasingly vulnerable. China maintains a large and growing arsenal of nuclear, maritime, conventional long-range strike, cyber, and space capabilities able to directly threaten Americans’ security. In 2024, Chinese cyberespionage campaigns such as Volt Typhoon burrowed into U.S. critical infrastructure, demonstrating capabilities that could disrupt the U.S. military in a conflict and harm American interests. The PLA continues to make steady progress toward its 2027 goals, whereby the PLA must be able to achieve “strategic decisive victory” over Taiwan, “strategic counterbalance” against the United States in the nuclear and other strategic domains, and “strategic deterrence and control” against other regional countries. In other words, China expects to be able to fight and win a war on Taiwan by the end of 2027.

The World Economic Forum’s Global Risk Assessment

Global Risks Reports 2026 World Economic Forum

In advance of the World Economic Forum (WEF) meetings in Davos ,Switzerland this coming week, the WEF released their 21st edition Global Risks Report 2026. The report analyses global risks through three timeframes to support decision-makers in balancing current crises and longer-term priorities. Chapter 1 presents the findings of this year’s Global Risks Perception Survey (GRPS), which captures insights from over 1,300 experts worldwide. It explores risks in the current or immediate term (in 2026), the short-to-medium term (to 2028) and in the long term (to 2036). Chapter 2 explores the range of implications of these risks and their interconnections, through six in-depth analyses of selected themes. Below are the key findings of the report, in which we compare the risk outlooks across the three-time horizons.

Recommended Weekend Reads

Is Trade Uncertainty Boosting Automation? Putin’s Fear of Economic Humiliation, American Soybean Farmers Feeling the Pain of China’s Boycott, And How Geopolitical Risk Impacts Consumer Spending

September 5 - 7, 2025

Each week, we gather up the best research and reports we have read in the past week and pass them on to you. Below is this week’s curated collection. We hope you find them interesting and informative, and that you have a great weekend.

Geoeconomics & Trade

Will Trade Uncertainty Boost Automation? Federal Reserve Bank of San Francisco

Recent surges in trade policy uncertainty highlight the fragility of global supply chains, prompting businesses to consider reshoring—moving production from abroad to domestic locations. Reshoring can be costly, creating incentives for businesses to automate. Evidence suggests that businesses facing heightened trade policy uncertainty in industries more exposed to international trade reshore more and automate more than those that are less exposed to trade. Automation appears to help mitigate the otherwise negative effects of trade policy uncertainty on production and labor productivity.

In Tariff Standoff with Trump, China Boycotts American Soybeans New York Times

China has rare earth metals. The United States and Brazil have soybeans. For all the chokeholds China maintains on global supply chains, it is overwhelmingly dependent on soybeans from other parts of the world. China imports three-fifths of all the soybeans traded on international markets. Now with China and the United States locked in a tense standoff over tariffs, soybeans have emerged as a central dispute between the trading partners. China has been boycotting purchases of U.S. soybeans since late May to show displeasure with President Trump’s imposition of tariffs on imports from China. The pain is being felt in Midwest states, especially Illinois, Iowa, Minnesota and Indiana. For the first time in many years, American farmers are preparing to harvest their crop this fall with no purchase orders from China.

Effects of Tariff Uncertainty on the Outlook of Small and Medium-sized Businesses Federal Reserve Bank of Boston

A large body of research demonstrates that uncertainty affects many dimensions of firms’ decisions, from investment and hiring to pricing and profitability. To gain a better understanding of how uncertainty induced by shifting trade policy shapes the behavior of small and medium-sized businesses (SMBs) the authors surveyed decision-makers at SMBs. Key Takeaways include:

Results from the survey indicate that uncertainty about tariffs rose markedly from the first wave to the third for all SMBs, and especially for importers.

Survey respondents with greater uncertainty about tariffs in April 2025 – and especially those that import – tended to report greater uncertainty about business operations, particularly about investment and worker head count.

The respondents indicated that a hypothetical reduction in business uncertainty would improve their expectations, but another increase in business uncertainty would not lead to further deterioration in their outlook.

The muted reaction to a hypothetical increase in business uncertainty suggests that by April 2025, the effect of increased uncertainty on SMBs’ expectations may have already peaked and/or that financial conditions had not tightened enough to notably amplify any negative real effects of further increases in uncertainty.

The Fiscal Impact of Immigration: An Update AEI Economic Perspectives

Immigrants have an overall positive fiscal impact on the US—an effect driven by high-skilled

immigrants. Low-skilled immigrants, like their US-born counterparts, impose a net fiscal cost.

However, recent studies show that the indirect fiscal effects of low-skilled immigration are positive,

partly offsetting the negative direct fiscal impact. Moreover, immigrants will help bear the cost

of future policy changes required to address the growing national debt. Smaller immigration

inflows might reduce fiscal pressure on state and local governments, but would increase fiscal

pressure on the federal government and slow economic growth.

The Impact of Geopolitical Risk on Consumer Expectations and Spending Yuriy Gorodnichenko, Dimitris Georgarakos, Geoff Kenny, and Olivier Coibion / NBER

Abstract: Using novel scenario-based survey questions that randomize the expected duration of the Russian invasion of Ukraine and Middle East conflict, we examine the causal impact of geopolitical risk on consumers’ beliefs about aggregate economic conditions and their own financial outlook. Expecting a longer conflict leads European households to anticipate a worsening of the aggregate economy, with higher inflation, lower economic growth, and lower stock prices. They also perceive negative fiscal implications, anticipating higher government debt and higher taxes. Ultimately, households view the geopolitical conflict as making them worse off financially and it leads them to reduce their consumption.

Russia’s Struggling Economy

Can Russia Weather a Fuel Crisis Caused by Ukrainian Drone Attacks? Carnegie Politika

Once again, Russia is in the grips of a gasoline crisis. Prices at the pump are rising, and some gas stations have run dry. This isn’t the first time Russia has experienced such shortages, but this time around they could be more serious because of the ongoing war in Ukraine. There were gasoline crises in Russia both before the full-scale invasion (in 2011,2018, and 2021), and afterward (in 2023). Despite a 2024 Ukrainian drone campaign targeting Russian refineries, the fuel market remained relatively calm. Back then, each refinery was only hit by a single drone, reducing plant capacity but leaving it operational. The damage was dealt with in a matter of weeks, consecutive attacks, were rare and often deflected, and neighboring plants continued to operate without interruption. Ultimately, the 2024 drone attacks caused inconvenience and expense for the Russian oil industry, but did not present a major problem. This time could be quite different.

Putin’s Fear of a Humiliating Economic Crisis Foreign Policy

Russian President Vladimir Putin has every reason to seek a lifeline for the Russian economy. In recent weeks, a flurry of signs has shown Russia’s war-drained, sanctions-constrained economy to be at an inflection point. For the first time since the start of the war, nonmilitary economic activity has been contracting, bankers are making plans to weather a financial crisis, and energy firms are worrying about losing their largest customer for seaborne oil exports. Putin’s intensifying economic troubles have important implications for Western policymakers as they begin negotiating with Moscow about the future of Ukraine. Unlike the impression the Russian leader tries to make, time is far from being on his side. In fact, economic pressure remains the best leverage that Ukraine’s supporters have over the Kremlin. It remains to be seen whether Europe and the United States will choose to play the economic ace they still have up their sleeves.

The Global Race for Critical Minerals

Why Is Renewing AGOA Strategic for U.S.-Africa Minerals Diplomacy? Center for Strategic and International Studies

The African Growth and Opportunity Act (AGOA), first signed into law by President Bill Clinton in 2000, is a unilateral U.S. trade preference program set to expire in September 2025. Its pending reauthorization has sparked debate over whether—and how—it should be extended and reformed. A failure to extend AGOA could have larger ramifications at a time when the United States is doubling down on its commercial diplomacy—and more specifically, its mineral diplomacy efforts—with Africa.

Europe’s Strategic Access to Battery Minerals in a Changing Geoeconomic Landscape The Hague Centre for Strategic Studies

Europe’s transition to a low-carbon economy hinges on the rapid deployment of battery technologies. Batteries are essential for stabilizing electricity grids powered by renewables and for enabling the shift from internal combustion engine (ICE) cars to electric vehicles (EV), especially after the European Union’s (EU) 2035 ban on new ICE cars. The successful deployment of batteries in Europe depends on secure supply chains, which are heavily concentrated. China plays a dominant role across the entire battery supply chain. It produces most of the world’s batteries and controls large shares of battery material mining and processing capacity, including graphite, lithium, manganese and phosphate. The Chinese government can use its control over battery supply chains to exert geopolitical pressure on other countries. To reduce its vulnerability, Europe could choose to look into types of batteries that rely less on raw materials whose supply chain is dominated by China.

Recommended Weekend Reads

Latin America Can De-Risk Semiconductor Supply Chains, Why Russian-Indian Relations Have Remained Steady, and Why Tariffs Led to More Demand for Stablecoins Went Up and Less for the Dollar

August 29 - 31, 2025

Here are our recommended reads from reports and articles we read in the last week. We hope you find these useful and that you have a relaxing weekend. And let us know if you or someone you know wants to be added to our distribution list.

Americas

Latin America’s Role in De-Risking Semiconductor Supply Chains Center for Strategic & International Studies

While the semiconductor supply chain currently spans several continents, China has made efforts to develop a self-sufficient semiconductor manufacturing ecosystem through industrial policies such as “Made in China 2025,” which presents a direct strategic and economic challenge to the United States. De-risking the semiconductor supply chain, particularly that of “legacy chips,” is of paramount importance, particularly at a time in which the Trump administration considers imposing additional sectoral tariffs on semiconductors. Latin America sits at the juncture of possibility and opportunity at a critical time for the expansion of semiconductor manufacturing, providing some of the key elements and capabilities that allow for semiconductor assembly, testing, and packaging as well as final integration into electronics. For companies relying on semiconductor manufacturing, diversifying production sources is key to reducing the risks associated with supply chain disruptions and great power competition.

Latin America’s Opportunity in the AI Race Americas Quarterly

In recent weeks, two starkly different visions of the future of the digital world emerged from the globe’s AI superpowers. These competing philosophies have put Latin America in an uncomfortable position between them. The region now faces a digital dependency trap that could determine its technological fate for decades. Last month, the Trump administration released “Winning the Race: America’s AI Action Plan,” a comprehensive national AI strategy that frames artificial intelligence as a zero-sum competition where the U.S. must achieve “unquestioned and unchallenged global technological dominance. China then unveiled its “Action Plan on Global Governance of Artificial Intelligence.” For Latin American policymakers, these manifestos present what appears to be a binary choice. Choosing wrong could mean decades of technological dependency, limited sovereignty, and diminished prospects for indigenous innovation. The tension between the two paths, however, could offer the region an opportunity for growth.

On the Ground With a Top Mexican Cartel New York Times

For the last year, Paulina Villegas, an investigative journalist for The New York Times, had the daunting task of meeting repeatedly with members of the Sinaloa Cartel. The assignment had obvious risks: The Sinaloa Cartel is a U.S.-designated terrorist group. But the meetings, Ms. Villegas said, were vital to her quest to provide readers a clearer understanding of how powerful criminal groups operate, documenting the practices and root causes that both the Mexican and American governments are trying to address.

The Indo-Pacific

Why Russian-India Relations Have Been Steady in the Storm War on the Rocks

Russia has more friends than Western analysts like to admit, even three years into the Russo-Ukrainian War. While many have paid close attention to Russia’s beneficial partnership with Iran, the introduction of North Korea’s legions into the Ukrainian battlespace, or persistent materiel support from China, Russia’s other rising-power relationship is often underdiscussed — that of India. The Russian-Indian relationship is both of longer duration and deeper history than those Russia has with its other key partners. It is also sometimes ignored as it does not extend to shared adversarial relations with the greater West. This is a mistake, as India is one of Russia’s self-identified civilizational friends. Furthermore, despite various ups and downs, the partnership has proven quite resistant to third-party pressures, including recently from the anti-Russian Western coalition.

What’s New About Involution? Carnegie China

In recent months “neijuan” (内卷), or “involution,” has become one of the most important buzzwords in Chinese policymaking circles. It has come to describe a disruptive process of relentless competition and price cutting among Chinese businesses, and has been increasingly criticized by policymakers, from President Xi Jinping down, for leading to a zero-sum race to the bottom, marked by vicious price wars, large-scale losses, homogenous products, and improper business practices. An August 2 article in Caixin explains: China’s top economic planner vowed on Friday to intensify its crackdown on “involution,” pledging to curb disorderly corporate competition, rein in wasteful investment and standardize local governments’ business attraction practices to protect fair market order. The article is referring to the July 30 Politburo meeting that set out Beijing’s priorities for the second half of 2025. Of the three main priorities, two—the need to boost domestic consumption and the promise to support the real estate market—have been proposed regularly in the past three to four years. Much of the focus, however, was on the newest priority, which is to battle deflationary pressures by reducing “disorderly” price competition and overcapacity in manufacturing—measures, in other words, aimed at reining in involution.

Xi Unleashes China’s Biggest Purge of Military Leaders Since Mao Bloomberg

China’s leader has ousted almost a fifth of the generals whom he personally appointed while running the country, something his predecessors never did, according to a Bloomberg News analysis of TV footage, parliamentary gazettes, and other public records. Moreover, Xi’s purge has left the CMC with only four total members, down from seven when his third term started. That’s the fewest in the post-Mao era, the Bloomberg analysis shows. As more and more of China’s top military leaders fall, it leaves those trying to understand the nation grappling with a near-impossible question, given the opaque nature of the Communist Party: Is this all a sign of Xi’s political strength, or of his weakness? The implications reach around the world and across the global economy.

Geoeconomics

Tariffs, Stablecoins, and the Demand for Dollars Federal Reserve Bank of Cleveland

Several studies have shown that aggregate demand for US dollars fell following the announcement of tariffs by the US government on April 2, 2025. Using data on stablecoins as a proxy for dollar trading, we find that the decline in dollar demand is smaller for investors in countries that saw larger increases in tariffs. Our interpretation is that, as foreign investors anticipate that tariffs will make it more expensive to acquire US dollars in the future, they buy dollars today. This channel is stronger for more liquid stablecoins and for countries with tighter capital controls, consistent with the idea that, when actual dollars are hard to acquire, stablecoins may be regarded as a substitute. Our findings cast light on the effects of the tariffs on global foreign exchange markets, as well as on the degree to which stablecoins are considered a close substitute for dollars.

America’s Coming Crash: Will Washington’s Debt Addiction Spark the Next Global Crisis? Kenneth Rogoff/Foreign Affairs

For much of the past quarter-century, the rest of the world has looked in wonder at the United States’ ability to borrow its way out of trouble. Again and again, under both Democratic and Republican administrations, the government has used debt more vigorously than almost any other country to fight wars, global recessions, pandemics, and financial crises. Even as U.S. public debt rapidly climbed from one plateau to the next—net debt is now nearing 100 percent of national income—creditors at home and abroad showed no signs of debt fatigue. For years after the 2008–9 global financial crisis, interest rates on Treasury debt were ultralow, and a great many economists came to believe that they would remain so into the distant future. Thus, running government deficits—fresh borrowing—seemed a veritable free lunch. Given the dollar’s reputation as the world’s premier safe and liquid asset, global bond market investors would always be happy to digest another huge pile of dollar debt, especially in a crisis situation in which uncertainty was high and safe assets were in short supply. The past few years have cast serious doubt on those assumptions.

How Chips Factor Into a De Facto US Sovereign Wealth Fund OMFIF

In July 2025, former Intel Chief Executive Officer Pat Gelsinger called for a US sovereign wealth fund to ‘keep America’s technological edge’. Just a month in, a US SWF has materialized under Donald Trump’s administration – owning 10% of Intel Corporation, the only American company manufacturing advanced chips on US soil. Traditionally, sovereign wealth funds are state-owned investment funds that manage national surpluses. Norges Bank Investment Management, for example, manages Norway’s export surplus derived from its natural resources. However, the US SWF is from a trade deficit country. It is not one single fund authorised by the legislature. Instead, it’s a strategy driven by executive power. Unlike a conventional SWF, the US SWF has no formal, top-down asset allocation plan. That’s why in the months following Trump’s executive order for establishing the fund, the US SWF appeared first as an ad hoc collection of US stakes in business sectors, ranging from attempted control over TikTok to a golden share in the proposed Nippon Steel-US Steel merger, to equities in bitcoins formerly collected from various criminal and civil actions of the US government.

Recommended Weekend Reads

Did Trump Just Hand China the Tools to Beat the US in AI?, The Strategic Mineral Alliance the West Needs, US Construction’s 5 Decades of Decline, and Democrats Face A Voter Registration Crisis

August 22 - 24, 2025

Here are our recommended reads from reports and articles we read in the last week. We hope you find these useful and that you have a relaxing weekend. And let us know if you or someone you know wants to be added to our distribution list.

AI’s impact on National Security and GDP

Trump Just Handed China the Tools to Beat America in AI Matt Pottinger & Liza Tobin/The Free Press

Pottinger, who served as Deputy National Security Advisor to President Trump in his first term, and Tobin, write President Trump’s team just gave China’s rulers the technology they need to beat us in the artificial intelligence race. If he doesn’t reverse this decision, they argue, it may be remembered as the moment when America surrendered the technological advantage needed to bring manufacturing home and keep our nation secure. They argue we should not believe the claims that these chips aren’t very advanced. China’s lack of unfettered access to U.S.-designed AI chips, they write, is America’s clearest advantage in the AI race. By reversing the ban, the White House is helping Beijing’s Communist regime close the gap.

Global Compute and National Security Center for New America Security

The United States faces a choice: leverage its current lead to promote U.S. AI infrastructure and applications globally, while preserving its edge at the frontier; or continue to primarily focus on protection, while other countries gradually narrow the gap. As Michael Kratsios, President Donald Trump’s science and technology advisor, put it: “It is not enough to seek to protect America’s technological lead. We also have a duty to promote American technological leadership.” The protect and promote strategy outlined in this report offers a path to sustainable leadership that both safeguards critical capabilities and expands American influence in the global AI ecosystem.

The Macro Impact of AI on GDP the Overshoot

Capital spending related to AI is growing so rapidly that it is now meaningful relative to the $30 trillion U.S. economy. Gross Domestic Product (GDP) was about 0.2%-0.3% larger in 2025Q2 than it would have been if businesses’ spending on data center construction, computers and peripheral equipment, and communications equipment had grown in line with the 2011Q1-2022Q31 trend. Moreover, this impact is likely understated, because existing methodologies are (probably) not fully capturing the investment being done by the five companies responsible for the bulk of the data center buildout: Amazon, Google, Meta, Microsoft, and Oracle. Those five companies also happen to be the ones with the five largest capex budgets in the entire S&P 500 in 2025Q2. I estimate that U.S. GDP would be about 0.4% higher than currently reported—or about 0.6% higher than if there had been no AI boom—if the capital expenditures of the big 5 were fully incorporated into the official data. Or put yet another way, the growth in direct AI-related capex by the big 5 since mid-2023 would correspond to about 10% of the total increase in the dollar value of U.S. GDP over the past two years. Including additional capital spending on power plants and electricity generation would lead to an even larger number.

Geoeconomics

Reform or Realignment? The Geopolitical Lessons of Bretton Woods Carnegie Endowment for International Peace

The history of Bretton Woods sharpens questions about the issues and interdependencies that can provide the basis for any reform of existing institutions.

Five Decades of Decline: U.S. Construction Sector Productivity Federal Reserve Bank of Richmond

Construction labor productivity in the US fell by more than 30 percent from 1970 to 2020, while overall U.S. economic productivity doubled over the same period; Despite potential biases in price deflators, multiple studies confirm that the productivity decline is real, with physical measures like housing units per worker showing similar stagnation, and; Increasing land-use regulations may be a plausible cause for the decline, as more strict land-use regulations disincentivize construction companies from pursuing larger projects, keeping them relatively small. In addition, this reduces incentives for technological innovation and economies of scale.

The Ghost in Capitalism's Machine: Industrial policy returns to global trade Peter Draper/ Hindrich Foundation

Industrial policy is the ghost in capitalism’s machine — always present, rarely acknowledged. Even laissez-faire economies flirt with it, while denying its existence. It attracts polarized views anchored in ideological conceptions over how much power to accord states, or freedom to markets. Industrial policy is making a comeback as geopolitical contestation amongst the major powers sharpens.

Russia, Ukraine, and the Economic and Security Implications of a Possible Ceasefire

Tanks, Tech, and Tungsten: The Strategic Mineral Alliance the West Needs War on the Rocks

What good is a tank if you can’t get the metals to build it? This week’s meeting between U.S., Ukrainian, and European leaders showed potential progress towards security cooperation. And while the new U.S.-Ukrainian Reconstruction Investment Fund agreement marks an important step toward increasing the resilience of both U.S. and European supply chains, there is more work to be done. Building on this momentum, the United States and the European Union should seek closer critical minerals supply chain cooperation. There are several opportunities for the two economies to work together by focusing on defense and security, rather than the economic and clean energy framing of the past. Tighter cooperation could strengthen the E.U. defense-industrial base, enhance military readiness, and strengthen NATO’s deterrence posture while enabling the United States to secure critical minerals, preserve manufacturing capacity, and redirect precious resources to the Indo-Pacific. Supply chain cooperation would also help both sides reduce dependence on China, which dominates the critical minerals market by creating oversupply and using export restrictions. Indeed, the China challenge requires the United States and Europe to work together.

Russia’s Imperial Black Sea Strategy Foreign Affairs

Russia’s aggression against Ukraine and other neighbors is transforming the Black Sea into Eurasia’s strategic frontier. Russia has disrupted flows of energy, food, and other commodities; generated millions of migrants; and heightened insecurity not just in Ukraine but also across the entire Black Sea region. These efforts constitute part of a much longer and larger strategy. Russia does not merely seek to dominate Ukraine. It wants to render each of the other five states that border the Black Sea—as well as Moldova, which borders Romania and Ukraine and whose waters flow into the sea—subservient to its interests so that it can exercise veto power over choices these countries make. Moscow also aspires to use the Black Sea as a platform from which to project power and influence throughout the Middle East, the Mediterranean, and the Caucasus.

U.S. Politics & Elections

The Democratic Party Faces a Voter Registration Crisis The New York Times

According to an analysis conducted by the New York Times, the Democratic Party is hemorrhaging voters long before they even go to the polls. Of the 30 states that track voter registration by political party, Democrats lost ground to Republicans in every single one between the 2020 and 2024 elections — and often by a lot. That four-year swing toward the Republicans adds up to 4.5 million voters, a deep political hole that could take years for Democrats to climb out of.

Trump’s Tariffs and ‘One Big Beautiful Bill’ Face More Opposition Than Support as His Job Rating Slips Pew Research Center

The latest national survey by Pew Research Center – conducted Aug. 4-10 among 3,554 adults – finds that a 53% majority say President Trump is making the federal government work worse, while only about half as many (27%) say he is making the government work better. (Two-in-ten say he is making things about equally better and worse.) Both Republicans and Democrats now offer more negative assessments of Trump’s impact on the federal government than they had predicted in a survey conducted in the weeks immediately following Trump’s inauguration. Six months into his second term, public evaluations of President Donald Trump’s job performance have grown more negative. His job approval stands at 38% (60% disapprove), and fewer Americans now attribute several positive personal characteristics to him than did so during the campaign. Two of the new administration’s signature accomplishments – the rollout of its tariff policies and the tax and spending law known as the “One Big Beautiful Bill” – garner considerably more disapproval than approval:

61% of Americans disapprove of Trump’s tariff policies, while 38% approve.

46% disapprove of the tax and spending law, while 32% approve (23% say they are unsure).

55% of Republicans and Republican-leaning independents now say Trump is improving the way the federal government works – while 16% say he’s making things worse and 29% say his effect is a mix of positive and negative. In the weeks after he took office, 76% of Republicans expected he would make government work better.

87% of Democrats and Democratic leaners say Trump is worsening the way government functions, up from 78% who said this at the beginning of his term.

Recommended Weekend Reads

Mexico’s Oil Giant is at a Crossroads, Can Iran Rebuild its Nuclear Program, and Just How Desperate is their Leadership?, Why US House Prices Stayed Resilient Versus the Rest of the World, and America’s Population Crash

August 8 - 11, 2025

Below are a number of reports and articles we read this past week and found particularly interesting. Hopefully, you will find them of interest and useful as well. Have a great weekend.

The Americas

Pemex Is at a Crossroads Americas Quarterly

Mexico’s government announced a deal to support the deteriorating finances of the state-owned oil company, Petróleos Mexicanos SA (Pemex). By issuing instruments called pre-capitalized notes, the Sheinbaum administration hopes to stabilize the financial performance of a company that has been reporting losses for at least the last 10 years. However, Pemex is besieged not only by mounting financial liabilities but also by a series of issues that compromise its future and, to some extent, its current operations.

Assessing the Impact of China-Russia Coordination in the Media and Information Space Ryan Berg/Center for Strategic and International Studies

Since the announcement between Presidents Vladimir Putin and Xi Jinping of a “no limits partnership” on the eve of Russia’s 2022 invasion of Ukraine, concerns have swirled over the potential for a new axis of revisionist authoritarian powers. Spearheaded by Moscow and Beijing, such an alliance could not only threaten the Eurasian landmass but reach across oceans to challenge the United States in the Western Hemisphere. However, the full implications and scope of the China-Russia partnership, particularly as it may pertain to Latin America and the Caribbean (LAC). The CSIS Americas Program designed a novel tabletop exercise to better understand the consequences. The findings found that when given the opportunity to coordinate, China and Russia eagerly did so and were able to secure a favorable outcome to the initial crisis. However, on the subsequent game turn, the United States, which had invested in building more long-term influence in the region, nevertheless secured its preferred policy outcome in both iterations of the game This suggests that U.S. influence in LAC appears to remain sizeable, but closer China-Russia cooperation should be accorded more gravity than it currently receives in policy discussions.

Iran’s Future

Damage to Iran’s Nuclear Program—Can It Rebuild? The Center for Strategic and International Studies

In the immediate aftermath of the U.S. strikes on Iran’s nuclear facilities on June 22, “Operation Midnight Hammer,” policymakers and experts launched into a heated debate not only about the physical damage of the strikes but also about their impact on Iran’s long-term nuclear ambitions. Recent satellite imagery allows us to have a more realistic picture of the extent of the damage from the Israeli and U.S. strikes. It also provides insights into Iran’s initial efforts to rebuild its nuclear program and can help identify potential pathways for developing a covert nuclear weapons program, including establishing a third site to process its existing stockpile of 400 kilograms (kg) of highly enriched uranium (HEU). We determined that the U.S. and Israeli strikes inflicted significant damage on Iran’s nuclear program by destroying key infrastructure and human capital. Israel’s broader campaign against Iran also targeted military leaders, Iranian missiles, and defense industrial base targets. The precision of these operations revealed a deep penetration of intelligence, particularly by Mossad, into Iran’s nuclear program. The strikes did not, however, completely eliminate the nuclear program, with some infrastructure remaining intact, and the status of the HEU stockpile remains unknown. But whether or not Iran rebuilds its nuclear program is ultimately a political decision and will depend on three sets of factors: decision-making in Tehran, diplomacy with the United States, and Israel.

Iran’s Dangerous Desperation: What Comes After the 12-Day War Suzanne Maloney/Foreign Affairs

As the writer James Baldwin once remarked, “The most dangerous creation of any society is the man who has nothing to lose.” That description might now apply to the men who preside over the ruins of Iran’s revolutionary system. With their proxy network degraded, their air defenses demolished, and their great-power alignments exposed as hollow, the debilitated guardians of the Islamic Republic require new tools to keep the wolves at bay. It is difficult to predict with confidence how factional dynamics will evolve in the aftermath of the regime’s humbling; further surprises may be in store. But there can be little doubt that the most powerful set of players in Tehran will seek to reconstitute the remnants of its nuclear program and reassert the regime’s dominance over Iranian society.

U.S. Economics and Demographic Changes

Why U.S. House Prices Stayed Resilient While Prices Fell in Other Countries Federal Reserve Bank of St. Louis

Following decades of low and stable inflation, the period from 2021 to 2024 marked a dramatic global surge in inflation and an unprecedented cycle of monetary tightening. This recent monetary tightening cycle created a puzzle: Why did housing markets across developed countries respond so differently to the same global pressures? For example, during the 2020-21 expansion, the U.S. and Canada experienced house price appreciation of more than 25% while Sweden recorded increases approximately half as large. (See the first figure.) But when central banks began aggressive tightening in 2022, a striking divergence emerged. The U.S. housing market showed remarkable resilience, with only moderate price adjustments despite Federal Reserve rate hikes that pushed mortgage rates from 2.8% to 6.8%. In stark contrast, Sweden and Canada experienced sharp corrections, with Swedish prices falling substantially below their 2019 baseline levels.

Sprinters, Marathoners & Skeptics on the Future of AI & Power War on the Rocks

Will AI eat the world and America’s defense budget? I think of those who toil at the intersection of AI and national security as being divided into three camps: Sprinters hold the most aggressive assumptions and believe profound disruption via artificial general intelligence is imminent; marathoners believe the technology will diffuse selectively, sector-by-sector; and skeptics draw analogies to the dot-com bubble. America’s near-term AI strategy should align with one of these three approaches. If the sprinter scenario holds, the United States should go all-out to rapidly acquire artificial general intelligence — defined here as human-level intelligence. If the skeptics are right, however, then the United States should do virtually the opposite and avoid overbuilding and overextension. If the marathoners are most correct, then the United States will conduct a complicated, long-term technological competition with a country four times its population.

Consumer Inflation Expectations Across Surveys and over Time Federal Reserve Bank of Cleveland

Different survey-based measures of consumer inflation expectations have diverged in recent months. This Economic Commentary compares these measures and the survey questions underlying them. Our analysis suggests that the divergences across survey-based measures of inflation expectations can be attributed to various features and sample characteristics specific to each survey.

Changes in Milestones of Adulthood U.S. Census Bureau

ABSTRACT: This study uses nationally representative data from 2005 and 2023 to examine changes in young adults’ (ages 25-34 years old) experiences reaching five milestones of adulthood: living away from their parents, completing their education, labor force participation, marrying, and living with a child. Changes are considered for individual milestones, as well as for combinations of milestones. The types and combinations of milestones young adults experience have seen major shifts in the past several decades, with growth in the shares experiencing economic markers, and reductions in those who experience family formation events. between 2005 and 2023, the fraction of Americans aged 25–34 who completed their education rose from 74% to 83%, but the percentage of “ever married” fell from 62% to 44%, and the percentage with “a child in the household” fell from 55% to 39%.

America’s Fertility Crash Reaches A New Low The Economist

In recent years, birth rates have dropped only slightly in places where they have long been low. Four of the five least fertile states in 2014, including Connecticut and Massachusetts, have seen their rates decrease by less than the national average. It is in states that have been historically the most fertile where the fall has been precipitous; Alaska, North Dakota and Utah have seen some of the steepest declines. All told, states that had above average fertility rates in 2014 are responsible for more than 80% of the collapse in American birth rates over the past decade.

As US population growth slows, we need to reset expectations for economic data Peterson Institute for International Economics

US population growth has slowed sharply in the last year and a half, as the immigration surge of the early 2020s has ended and the population continues to age. Fewer jobs are needed to keep up with the growth of the labor force, and growth rates of output and consumption will fall even if per capita output and consumption hold steady. The total US population is growing at an annualized rate of 0.5 percent, down from 1 percent in late 2023. With slower population growth, any given level of monthly payroll growth, consumption growth, or output growth reflects a stronger economy than it did a year ago. Population growth is not only slowing; it has also become more volatile and harder to estimate. It is likely that current population estimates for 2025 that statistical agencies are incorporating into economic data are too high and will be revised downward; current population estimates imply much higher immigration in 2025 than is likely under current administration policy. Economic data will need to be reinterpreted and revised in line with future adjustments to population estimates.

Recommended Weekend Reads

The Trump Trade Wars Bring Major Shifts in US Chip Policy, Escalating Risk of Conflict on the Moon, 5 Facts About Global Demographic Changes by 2100, and What’s Going on with the Grid?

August 1 - 3, 2025

Below are a number of reports and articles we read this past week and found particularly interesting. Hopefully, you will find them of interest and useful as well. We hope you have a great weekend.

Trade Wars & Semiconductors

US alters tech policy, puts chips on the table Jennifer Lee & Fritz Lodge/The Strategist

A shift is underway in the Trump administration’s approach to tech policy. Nvidia said on 14 July that the US government would soon grant it licenses to resume exports of its H20 chips to China. AMD is expecting the same for its MI308 chips. This may appear surprising after multiple statements from Trump administration officials that controls on the export to China of higher-end AI chips, such as the H20, were off the table. This move doesn’t change the broader bipartisan consensus behind restricting China’s access to strategic tech, but rather fits into a pattern of recent decisions showing that tech export controls—previously viewed as a non-negotiable issue of US national security—can now be used as bargaining chips in trade talks with China. This shift exacerbates uncertainty for domestic and international tech firms and will encourage Beijing to push for further loosening of controls in future negotiations.

How Does Semiconductor Trade Work? Chris Miller/American Enterprise Institute

Trade data on semiconductors is skewed due to the underreporting of imported semiconductors found in finished products like cars and phones. Any tariffs on semiconductors must carefully consider the structure of supply chains to avoid unintended consequences. Much of the $40 billion of chips the US imports are actually made in the US, packaged abroad, and reimported, so tariffs would senselessly penalize domestic manufacturers. Since the US lacks packaging capacity, higher tariffs would raise costs and hurt competitiveness in key industries. The US should focus tariffs on Chinese-made chips while striking sectoral trade deals with allies that commit both sides to zero tariffs, reducing non-tariff barriers, and continuing to invest in diversified supply chains.

Demographics

5 facts about how the world’s population is expected to change by 2100 Pew Research Center

Here are five facts about how the world’s population is projected to change in the coming decades, based on a Pew Research Center analysis of the UN’s World Population Prospects. The latest data is from 2023, so the numbers for 2024 and beyond are projections.

1. Global population growth is expected to slow between now and 2100 (the population is expected to peak at 10.3 billion in 2084).

2. The world’s three most populous countries in 2025 are expected to have radically different trajectories in the coming decades (India will grow, China has begun to shrink and fall sharply, and the US is expected to grow slowly and steadily).

3. Five countries are expected to contribute more than 60% of the world’s population growth by 2100 (The Democratic Republic of Congo, Ethiopia, Nigeria, Pakistan, and Tanzania).

4. The world’s population is expected to get older (the median age is projected to rise to 42 by 2100, up from 31 today and 22 in 1950).

5. Africa is currently the world’s youngest region, and it’s projected to stay that way in 2100.

Why Is Fertility So Low in High Income Countries? Melissa Schettini Kearney & Phillip Levine/NBER

This paper considers why fertility has fallen to historically low levels in virtually all high-income countries. Using cohort data, we document rising childlessness at all observed ages and falling completed fertility. This cohort perspective underscores the need to explain long-run shifts in fertility behavior. We review existing research and conclude that period-based explanations focused on short-term changes in income or prices cannot explain the widespread decline. Instead, the evidence points to a broad reordering of adult priorities with parenthood occupying a diminished role. We refer to this phenomenon as “shifting priorities” and propose that it likely reflects a complex mix of changing norms, evolving economic opportunities and constraints, and broader social and cultural forces. We review emerging evidence on all these factors. We conclude the paper with suggestions for future research and a brief discussion of policy implications.

Depopulation Globally and in the Asia-Pacific: The Shape of Things to Come Nicholas Eberstadt/Fertility and Sterility

Abstract: This article addresses the prospect of global depopulation and its far-reaching implications. It argues that the advent of world population decline may come sooner than commonly anticipated, due to remarkable drops in birth rates underway in low-income regions as well as more developed locales. Notwithstanding uncertainties about the precise level of planetary fertility (due mainly to limited statistical capabilities in Africa), it is clear that overall childbearing patterns for our species are at most only slightly above the replacement level today—and might already actually have fallen below that significant threshold. Prolonged sub-replacement fertility will have far-reaching social, economic, and political ramifications. The following pages attempt to describe some of them, and to offer an introductory exploration of the new questions that could face problem-solvers in the future.

Africa’s future demographic dividend matters to Europe today ISS/African Futures

Africa’s demographic surge offers Europe a chance to rethink labor, migration and global partnerships through a lens of long-term interdependence. Europe’s population is shrinking, while Africa’s is growing. By 2050, Africa will be home to one in four people globally. Similarly, the EU’s labor force is shrinking and aging, while Africa’s is growing rapidly and becoming younger. By 2050, more than 60% of Africa’s people will be of working age. In Sub-Saharan Africa, the labor force will more than double. It will have increased from 505 million in 2023 to 1,058 million people, while Europe’s labor force will have declined from 370 million to 342 million.

The Growing Electrical Supply Challenge

AI Demand Drives Record Electricity Supply Costs In Largest US Market Financial Times

The cost of providing electricity in America’s largest power market will hit a record high owing to soaring demand from artificial intelligence data centers and delays in building new power plants, raising energy prices for consumers. Grid operator PJM said it procured energy supplies for $329.17 per megawatt day, a 22% increase compared with the previous year. The organization will pay power producers $16.1bn to meet its energy needs from June 2026 to May 2027, a 10% increase compared with the previous year. The operator said it expected a 1-5% rise for customers in their energy bills, depending on how utilities and states passed on costs. PJM sets prices at an annual capacity auction where power suppliers bid to provide the region’s projected demand. Earlier this year, PJM and some state governments took steps to try to keep power prices lower after last year’s capacity auction delivered a $269.92 per MW-day price — a more than 800% increase from 2023.

Power Check: Watt’s Going On With The Grid? Bank of America Institute

The US grid is facing an extended period of load growth. And while the drivers of this growth have changed over time, demand is largely due to 1) building electrification; 2) data centers; 3) industrial demand; and 4) electric vehicle (EV) adoption. If load growth forecasts continue to rise, utilities will need to invest to meet required reserve margins and increase spending on both power generation and transmission & distribution capacity. The good news? Deregulation and accelerated permitting may further help get more projects off the starting line, according to BofA Global Research.

Are Small Modular Reactors Worthy of the Hype? Oilprice.com

Nuclear energy is experiencing a political and technical renaissance. Around the world, nuclear fission is gaining traction as a critical piece of the puzzle for maintaining energy security while also slashing greenhouse gas emissions. Much of the renewed excitement over nuclear power comes from advances in nuclear technologies, particularly small modular reactors (SMRs), which are supposed to make nuclear capacity expansion cheaper, safer, and more efficient. However, Even though there is excitement from investors and policymakers alike, getting SMR models approved is taking much longer than anticipated. Only one model has been approved in the United States, and it is not yet operational. But many, many more designs are waiting in the wings.

Recommended Weekend Reads

June 20 - 22, 2025

Assessing Israel’s Attack and the Limits of Iran’s Missile Strategy, A Hitchhiker’s Guide to the Fed’s Role in the Fixed Income Market, and Analyzing the Pentagon Pizza Index

Below are the studies and reports we found of particular interest this past week. We hope you find them of interest, too. Please let us know if you have any questions or if you or a colleague wants to be added to our distribution list.

The Israel-Iran Crisis

How Iran Lost – Tehran’s Hard-Liners Squandered Decades of Strategic Capital and Undermined Deterrence Afshon Ostovar/Foreign Affairs

Iran’s hard-liners overplayed their hand. After Hamas attacked Israel on October 7, 2023, the regime’s leaders opted for a campaign of maximum aggression. Rather than letting Hamas and Israel fight it out, they unleashed their proxies at Israeli targets. Israel, in turn, was compelled to expand its offensive beyond Gaza. It succeeded in severely degrading Hezbollah, the most powerful of Tehran’s proxy groups, and eviscerating Iranian positions in Syria, indirectly contributing to the collapse of the Assad regime. Iran responded to this aggression by unleashing the two largest ballistic missile attacks ever launched against Israel. But Israel, backed by the U.S. military and other partners, repelled those attacks and incurred little damage. It then struck back. With that, the foundation of Iran’s deterrence strategy crumbled. Its ruling regime became more vulnerable and exposed than at any point since the Iran-Iraq War of the 1980s. And Israel, which has dreamed of striking Iran for decades, had an opportunity it decided it could not pass up.

Israel’s attack and the limits of Iran’s missile strategy International Institute for Strategic Studies

Israel’s attack on Iran has exposed critical weaknesses in Tehran’s broader military strategy. While Iran still has untapped shorter-range capabilities it could deploy in its immediate neighborhood, its depleted medium-range missile arsenal and weakened regional allies leave it with limited options for retaliation against Israel.

Options for Targeting Iran’s Fordow Nuclear Facility Center for Strategic and International Studies

In order to achieve its stated objective of dismantling Iran’s nuclear program, Israel will need to take out a key Iranian facility, the Fordow Fuel Enrichment Plant. Fordow is buried deep under a mountain near Qom and is believed to be one of the key sites of Iran’s nuclear enrichment activities, about 54,000 square feet in size, with 3,000 centrifuges. Due to its hardening and depth, Israel lacks the ordnance to take out Fordow on its own in the short term; however, multiple strikes from the U.S. GBU-57, carried out by U.S. B-2 bombers, could destroy the facility. There are at least five options for destroying Fordow. All of them will have varying degrees of impact on Iran’s nuclear program, along with unique risks of escalation and international response. Below is an analysis of all five options; however, to avoid escalation while still achieving nonproliferation objectives, Israeli sabotage appears to be an underappreciated option.

Geoeconomics

Black Swans and Financial Stability: A Framework for Building Resilience Daniel Barth/Stacey Schreft – Federal Reserve Board of Governors Finance and Economics Discussion Series (FEDS)

Abstract: This article refines the concept of black swans, typically described as highly unlikely and catastrophic events, by clearly distinguishing between knowable and unknowable events. By emphasizing that black swans are “unknown unknowns,” the article highlights that the realization of new black swans cannot be prevented and motivates a need for policies that build the financial system's resilience to unforeseeable crises. The article introduces a "resilience principle" that calls for policies that are adaptable, universal, and systemic. Examples are provided of policies with these features, none of which relies on the official sector being better positioned than the private sector to anticipate the unknown.

Bank Financing of Global Supply Chain Federal Reserve Bank of Atlanta Working Paper Series

Abstract: Finding new international suppliers is costly, so most importers source inputs from a single country. We examine the role of banks in mitigating trade search costs during the 2018–19 US-China trade tensions. We match data on shipments to US ports with the US credit register to analyze trade and bank credit relationships at the bank-firm level. We show that importers of tariff-hit products from China were more likely to exit relationships with Chinese suppliers and find new suppliers in other Asian countries. To finance their geographic diversification, tariff-hit firms increased credit demand, drawing on bank credit lines and taking out loans at higher rates. Banks offering specialized trade finance services to Asian markets eased both financial and information frictions. Tariff-hit firms with specialized banks borrowed at lower rates and were 15 percentage points more likely and three months faster to establish new supplier relationships than firms with other banks. We estimate the cost of searching for suppliers at $1.9 million (or 5 percent of annual sales revenue) for the average US importer.

A Hitchhikers Guide to Federal Reserve Participation in Fixed Income Markets Journal of Economic Perspectives

The Federal Reserve has historically relied on banks and primary dealers, [but] the landscape for fixed income ownership shifted after the 2007–2009 financial crisis, and again after the March 2020 crisis. As of the end of 2024, [non-bank financial institutions] are more than three times larger than the US banking system. Participation of investment funds—including mutual funds, money market funds, hedge funds, money managers, and investment advisors—in auctions of Treasury securities increased from 1.7% in January 2008 to 67.8% in October 2023, whereas the share attributable to dealers and brokers’ share decreased from 79% to 19.4% during the same period.

Investment in an increasingly global landscape Bank for International Settlements (BIS)

Private business fixed investment has fallen or remained flat in advanced economies for decades, with a recent levelling-off also observed in several emerging market economies. The recent increase in uncertainty due to trade tensions will dampen investment while also reducing the effectiveness of monetary policy. In the long run, the outlook for private business investment depends on the potential need to reconfigure supply chains disrupted by higher trade tariffs as well as governments’ efforts to boost public investment and implement structural reforms.

Africa

Africa’s Complicated Democratic Landscape Center for Strategic and International Studies

In 2024, the global trend of voters rejecting incumbents was reflected in Africa, where opposition parties made significant gains in countries with relatively strong democratic institutions. These results stemmed from economic frustration, widespread dissatisfaction with poor governance, and changing demographics. The most critical elections of 2025 will be in countries where incumbents have used constitutional changes and institutional control to stay in power. As elections unfold, how voters engage with the process will be key to shaping the political future of their countries and the continent as a whole. There are several African elections worth watching in late 2025 to help make this determination: Cameroon, Tanzania, Côte d’Ivoire, and Guinea. Uganda's election in January 2026 is also one to watch.

21st-Century Africa: Governance and Growth The World Bank

When compared with the average living standards of the rest of the world, GDP per capita in Sub-Saharan Africa has declined over the past three decades. During the period 1990–2022, three distinct periods can be identified in the evolution of Sub-Saharan Africa’s real GDP per capita: a declining trend during 1990–2000 (from 30% to 25% of the world average), stagnant GDP per capita relative to the world during 2000-14 (fluctuating around 25%), and a declining trend from 2014 to 2022 (from 25% to 22% of the world average). The region’s lack of convergence in living standards with the rest of the world largely results from its inability to sustain growth over time. If Sub-Saharan Africa had grown (in per capita terms) at the same pace as the global economy since 1990, its level of income per capita in 2022 would have been more than 40% higher than its actual level. If it had grown at the same pace as emerging East Asia, the region’s income per capita would have been nearly three times its 2022 level. Currently home to 14% of the world’s working-age population, by 2100, Africa is projected to have 39%, representing more than a third of the workforce of the entire world.

Africa has a new space agency — here’s what it will do Nature Magazine

Africa’s first continent-wide space agency, the African Space Agency (AfSA), which was inaugurated in April, is looking to secure funding as its first projects get underway. AfSA is an initiative of the 55-member African Union (AU) and is headquartered in Cairo. It was established to coordinate the work of Africa’s existing efforts in space — more than 20 African countries have space programs. Priorities will include improving satellite communication, which provides crucial connectivity for rural populations. It also aims to generate and access data from space to track the effects of climate change, provide disaster relief, and aid agriculture, water, and food security.

China

Is China Really Growing at 5 percent? Federal Reserve Board of Governors FEDS Notes

Chinese authorities recently announced a growth target of "around 5 percent" for 2025, the same as their 2024 target. Five percent is about half the pace of growth that China sustained from the 1980s to the early 2010s, but it is nonetheless quite high for an economy flirting with deflation and mired in a years-long property bust. The ambitious growth target, given the circumstances, has led many observers of the Chinese economy to once again treat the official GDP data with skepticism. All told, assessing the accuracy of China's GDP growth remains a challenge, and no statistical model can provide a definitive alternative measure. But our analysis suggests that official figures have not recently been overstating GDP growth for three reasons. First, the excess smoothness of official GDP has significantly diminished since the pandemic. Second, our alternative indicator, which relies on a broad set of data series informative about the Chinese business cycle, including consumption and the property sector, closely tracks official GDP. Finally, the supply side of China's economy has performed remarkably well in the context of robust demand for Chinese goods and industrial policies promoting self-reliance.

China’s Car Industry Runs on Empty as Supply Chain Bills Go Unpaid Financial Times

In an effort to shore up automotive supply chains, the Chinese government mandated a 60-day supplier payment rule. Most carmakers suffer from negative working capital; only a handful of Chinese EV makers have sufficient net cash to comply with the new rule.

Assessing Geopolitical Risk

Pentagon Pizza Index: The theory that surging pizza orders signal a global crisis Fast Company

A different kind of pie chart is being used to predict global crises. A surge in takeout deliveries to the Pentagon—now dubbed the “Pentagon Pizza Index”—has emerged as an unexpectedly accurate predictor of major geopolitical events. Tracking activity at local pizza joints in Arlington County, the X account Pentagon Pizza Report noted an uptick in Google Maps activity from four pizza places near the Pentagon on June 12. We, The Pizza, District Pizza Palace, Domino’s, and Extreme Pizza all reportedly saw higher-than-usual order volumes around 7 p.m. ET. “As of 6:59 p.m. ET nearly all pizza establishments nearby the Pentagon have experienced a HUGE surge in activity,” the X account posted. The timing? Just hours before news broke of Israel’s major attack on Iran.

Geopolitical Shift: Corporate America’s Growing Focus on Global Risk U.S. Chamber of Commerce

Geopolitical risks are no longer a distant concern for businesses—they are a top-tier strategic and financial challenge. From supply chain disruptions to shifting regulations and market volatility, global instability now shapes investment decisions, corporate strategy, and economic security. As a result, companies across all sectors are reporting more geopolitical concerns in their investor communications since 2009. This trend has accelerated sharply since 2019. And technology companies show the highest levels of concern, though the increase spans all industries.

Recommended Weekend Reads

What To Do When The START Treaty Expires, China’s Strategy for Countering the US’s New Focus on Latin America, the Economic and Geopolitical Implications of Apple’s Supply Chain, and Why Denmark Raised the Retirement Age to 70

June 6 - 8, 2025

Below is a collection of studies and articles we found particularly interesting and of likely impact on markets and public policy. We hope you find them helpful and that you have a great weekend.

The Future of Nuclear Weapons and Arms Control

No New START Franklin Miller/Eric Edelman, Foreign Affairs

The looming expiration of the New START Treaty, the only remaining bilateral nuclear arms control agreement between the United States and Russia, has focused national security experts on what comes next. At the time it was signed in 2010, New START had some advantages. But New START was written for a geopolitical landscape that no longer exists. Fifteen years later, the world has changed dramatically. Putin and Chinese leader Xi Jinping have emerged as aggressive and expansionist leaders, both dedicated to building a much more modernized and lethal nuclear weapons system.

Everything Changes but Nothing Changes: Can France Overcome Its Own Nuclear Doctrine? War on the Rocks

In a recent interview broadcast live on French television, President Emmanuel Macron said, “Ever since there has been a nuclear doctrine, Charles de Gaulle, there has been a European dimension of France’s vital interests. I have remained ambiguous on what those vital interests are…” Does France consider defending European allies part of their vital interests? Does France believe in extending a nuclear umbrella that covers Europe? These questions have been debated in France for decades, and with Russia’s aggression toward Ukraine, they have risen to a new level of focus and discussion.

Latin America

What Will China Do Next in Latin America? Ryan Berg/Foreign Policy

The second Trump administration has begun with a flurry of activity in Latin America. In the first 100 days, Secretary of State Marco Rubio visited both Central America and the Caribbean, Secretary of Defense Pete Hegseth made a visit to Panama, and Secretary of Homeland Security Kristi Noem visited both South America and Central America and Mexico. Another visit to the region by Rubio and a trip by Secretary of Agriculture Brooke Rollins are in the works. Some administration officials have characterized their approach as an “Americas First” foreign policy. The reprioritization of Latin America in the United States’ foreign policy, coupled with the high-level visits by cabinet officials, has placed China on the back foot in the region—at least temporarily. In many ways, Beijing was unprepared for the Trump administration’s considerable focus on the Western Hemisphere and its scrutinizing of countries’ relationships with China. Curiously, though, despite a revamped U.S. posture in Latin America, China appears to be sticking to a familiar bag of tricks—even as domestic challenges pare back the robustness of its offer.

Momentum for Red Tape Reform in Chile Picks Up Americas Quarterly

The decision by Chile’s government to scrap the massive Dominga copper and iron mining project in January, and the resulting court battles, have roiled debates over red tape and regulation in the country, where natural resources make up 77.6% of exports. These debates—which go far beyond the mining sector—have become a campaign issue ahead of the November general election as the business community demands lighter regulation and President Gabriel Boric defends his record and tries to forge compromises with his critics.

The War on Trees – How Illegal Logging Funds Cartels, Terrorists, and Rogue Regimes Foreign Affairs

Around the world, nefarious state and nonstate actors are extracting enormous value from forests to fund their operations. The unlawful clearing of land and the harvest, transport, purchase, and sale of timber and related commodities have long been dismissed as a niche concern of environmental activists. But this is a mistake. Although unsustainable deforestation imperils the environment, illegal logging also poses an outsize—and underacknowledged—geopolitical threat. Environmental crime constitutes a growing economic and national security threat to the United States and countries around the world. Yet Washington has largely ignored illegal logging’s role in its fight against transnational criminal organizations, drug cartels, terrorists, and rogue regimes, as well as China’s part in this illicit trade.

Geoeconomics

Why Emerging Markets Weathered Federal Reserve Tightening So Well Steven Kamin/AEI Economic Policy Working Paper Series

The steep rise in US interest rates that started in 2022 led many observers to anticipate severe difficulties for emerging market economies (EMEs). Unlike after the Volcker disinflation of the early 1980s or the bond market turmoil of 1994, however, most EMEs weathered the Fed’s monetary tightening in 2022-23 relatively well. In particular, EME dollar credit spreads, an indicator of potential financial distress, rose only moderately in those years before dropping to historically low levels in 2024. One reason that the EMEs weathered Fed tightening so well is that, simply put, Fed tightening is no longer as injurious to them as commonly believed; this likely reflects improvements in EME policies since the 1980s and 1990s that have bolstered their resilience. A second reason why EME spreads remained relatively contained in the face of rising interest rates is that US corporate credit markets remained buoyant, and their confidence spilled over to EMEs. We show that US high-yield spreads accounted for the lion’s share of the fluctuations in EME spreads over the past couple of decades, dominating not only the effects of monetary shocks but also changes in the VIX and the dollar.

Connectivity Policy – A Strategic Tool for the EU in its Eastern Neighborhood German Council on Foreign Relations

Given the shifts in the geopolitical landscape, connectivity is no longer just an economic tool – it has become a strategic instrument used for influence, resilience, and security, as China has demonstrated with its Belt and Road Initiative. The EU must understand that connectivity is central to its engagement with the Eastern Partnership (EaP) countries, where the EU faces growing competition not only from China’s BRI but also from Russia’s infrastructure dominance and Turkey’s regional ambitions. This memo explores the new momentum that connectivity has gained as a part of the EU foreign policy in the EaP and examines its significance in the emerging new regional order. It assesses whether and how connectivity can be reframed as a strategic instrument for the EU’s engagement.

Apple’s Supply Chain: Economic and Geopolitical Implications Chris Miller/Vishnu Venugopalan – American Enterprise Institute

Over the past decade, many electronics firms have talked about diversifying their supply chains. An analysis of Apple—America’s biggest consumer electronics firm—illustrates that most of its manufacturing supply chain remains in China, though there have been limited increases in Southeast Asia and India. China’s role for Apple has grown substantially. Ten years ago, Apple relied on China primarily for final assembly, while today Apple not only assembles devices in China, it also sources many components from the country. However, Chinese-owned firms generally only play a role in lower-value segments of the supply chain. Many of the higher-value components—even those made in China—are produced in factories owned by Japanese, Taiwanese, or US firms.

Immigration and Demographics

America’s Immigration Mess: An Illustrated Guide Nicholas Eberstadt/American Enterprise Institute